Tracked & Timestamped - Introduction & Guide

Educational Trading / Investment Signal Service With FULL Trading History, Comprehensive Performance Data & Complete Transparency.

Quick Guide: How To Follow Trades & Investment Signals On This Blog

Read the Extended Guide & all content below it to fully understand how this blog works. If you just want to quickly understand how a free / paid subscriber can get access to my trade signals, continue reading this chapter:

For All Subscribers:

Download the “Substack App” from IOS / Android - OR - Use the website and make an account & login at Theobeownsya.substack.com. You will need this to receive notifcations and actually read my work.

All Subscribers:

Follow all my content at https://theobeownsya.substack.com/notes - I will occasionally share and update free trades there, investments and other market-related macroeconimcs, politics, etc.

Make sure you have enabled notifications on my blog, and for notes. You can change these in your profile settings for substack content you’re subscribed to.

Make sure you’re receiving emails for my new blog post releases. If you’re a free subscriber, you are now all set up.

For Paid Subscribers:

In my “General Chat” (click link) - make sure you’re logged in to your account. If you’re a paid subscriber, request for access to my Paid Subscriber Spreadsheet, which will constantly and continously contain all open / closed trades that I am managing during any trading period. This is a great way to get access to my trades, both closed and open, the results and of course, the data.

On my substack chat frontpage:

you can now use the Substack App on either IOS or Android, or the webpage, to receive notifications on all Short Term or Long Term trades/investments I share. They will show up as replies to the threads containing the relevant market I am focused on. For each of these threads, either Long Term or Short Term, you must turn on the “bell” notification icon to receive updates on your phone (best method) or via desktop notifications from the web page. That way, you will get live-notifications when I share/update trades and investments. You can click on “replies” to see the content under each thread, relevant to the specific timeframe and market of your choice. You need not allow notifciations for all markets. I personally recommend Indices Long Term & Short Term, Forex Long Term & Short Term.

The bell will have a backslash “/” when notifications are not enabled. If you click inside of a thread, you will be able to see if you’re receiving notifcations or not. Then manage the notifcations as you wish on your webpage/smartphone. For this, you need to consult the browser or smartphone you’re using. Many guides online exists to help you enable notifcations “per app”, such as Substack:

The “red circle” marks what the bell notification icon looks like when you’re receiving notifcations.

3. That’s it! Now you simply have to watch for your phone to send alarms, or you can watch the substack chat or spreadsheet yourself, manually.

The rest of this post will fully explain all the details about how this blog came to be, is designed, works, and why it’s honest/real/transparent.

Enjoy.

Extended Guide

This post will be edited as more information is made available.

I want to start out with the equity curve of the performance of all investment and trading decisions I have shared so far, on this blog. The above orange line: The result of 2 years of hard work on this blog, starting at a selected entry size of $10.000, ending it well above $600.000. sharing every single trade, win AND loss, with evidence of every single execution. On google spreadsheets, I have collected all Tradingview screenshots, with the EXACT links shared at the EXACT timestamp on my substack chat (These can all be accessed for free, so you can verify every trade and investment decision yourself with the tradingview screenshot link, as well as the timestamp it was shared on the substack chat.

All my trading results & history can be found below:

Just Show Me Your Trading History And Proof Of Profit (Link)

And What About All The Timestamps Shared Live Of Every Trade (Link)

This blog is a continually developing journal that I use for my own trading, based on my private journals. Started trading, December 16, 2017. Now shared here on Substack since January 1, 2023, I provide free content & paid content in various formats.

What Kind Of Trader Am I?

I will never become the best trader in the world. Possibly never one of the best.

However, I do believe in my advantage:

Possibly one of, if not the very best, risk management systems of all time for the average trader. That would be for myself, and probably also for you.

The contrarian anti-dote to trading psychology problems, that, as far as I know, NO ONE ELSE is doing or talking about.

The near-perfect “routine optimization routine” for optimized living conditions for a trader

I know ALL the “EASY” trading methods that actually works, and I know which ones doesn’t. I know which ones will help YOU, and myself, the most. Just a level below rocket science stuff.

I will make lectures on these topics as my following grows.

The Content In This Blog

I share investment and trade ideas / studies based on data and transparency. That’s it. Whatever encapsulates the process of that, whether having to comment on macroeconomics, politics, or lifestyle, I get into those things gradually as well. Primarily, however, the goal of this blog is to: a) share journals I produce for myself anyway, easily, via this platform, and b) share data on live trades that are “audited”, verified and live, as to have all followers of my blog understand that the trades I share have been tracked and verified with a data collecting approach.

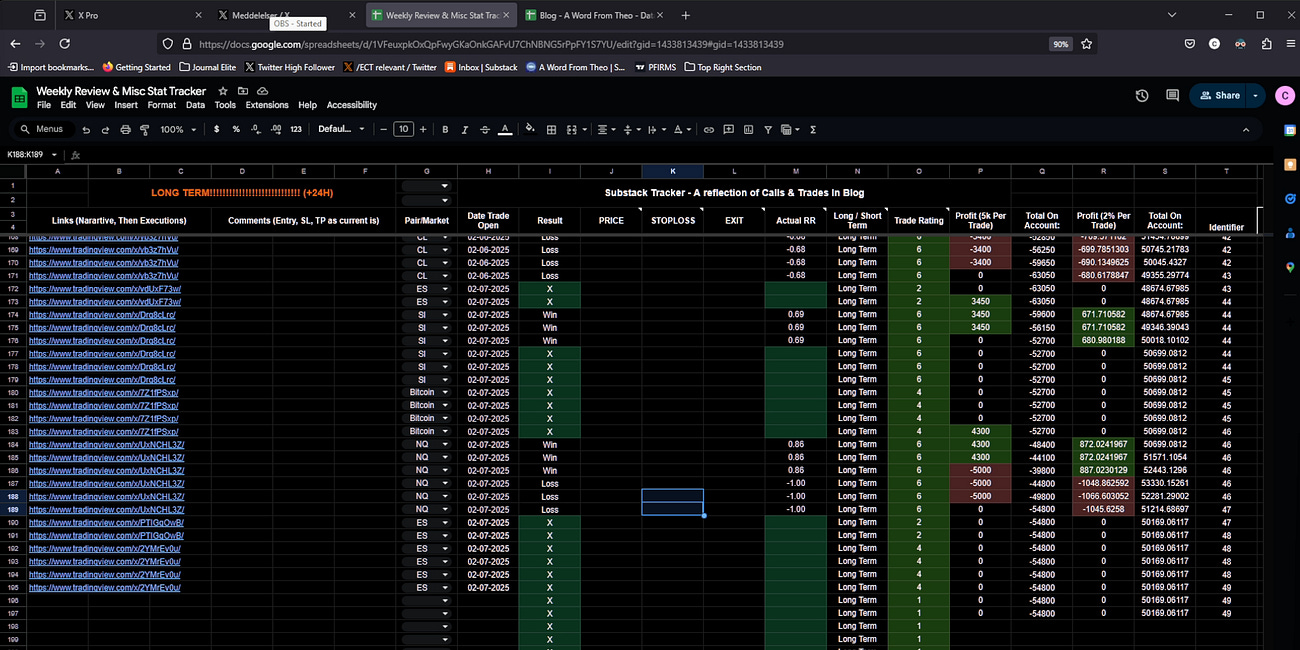

I share trades with a timestamp and screenshot (Tradingview.com)

I include the trade with a timestamp in a spreadsheet. (spreadsheets google)

I log the result of the trade (net RR return)

I collect the data over time. (See spreadsheet link below.)

You may be surprised at my results since January 1, 2023, which is why I encourage you to make sure you track my results in addition to my own, for at least a week, for free - so that YOUR data of how this blog works, will tell you, whether this is worth following for free or as a paid subscriber.

Be mindful of the Disclaimer that applies to all my content.

Free Subscriber vs Paid Subscriber vs Founder

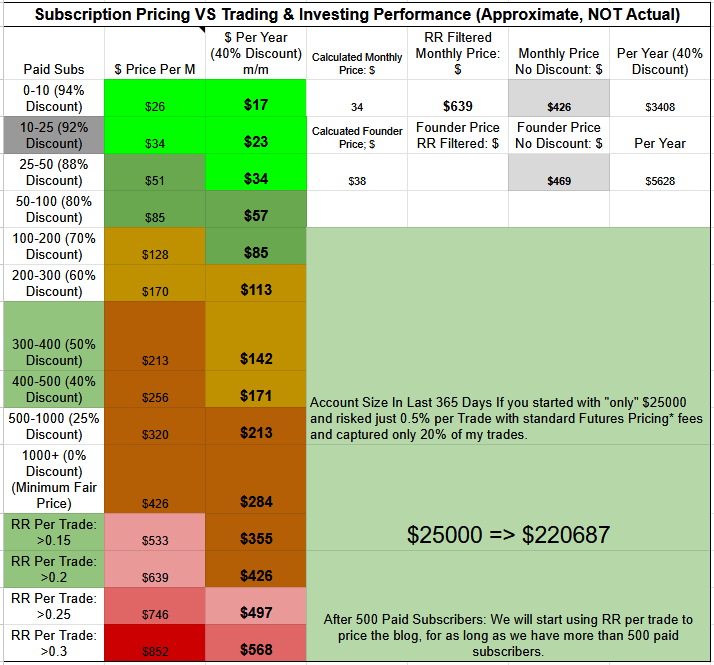

I run a free and paid subscription service to those who may find value in following my work. With the help of AI, I have estimated, currently, that the current fair value subscription cost of following my trade signals = $346 / $$346 per month. (As of March 6, 2025.) All oft his information can be found below.

As far as I know, very few, if any, are doing a paid educational signal service, like I do. I am running the only, educational, signal service where the cost of subscribing can go to 0 (based on performance.)

Free Subscriber Benefits:

Occasional live trades in blog posts, recordings or on social media.

Access to all historic trading data, datasheets & substack chat data to verify and audit all trades shared on this blog.

access to my occasional philosophical, psychological, political & macroeconomic essays and posts

Access to weekly / daily “Support & Resistance” levels from my “Arrow Market Prediction” series

Paid Subscriber Benefits:

All benefits from the Free Subscriber plan.

Access to my “Short Term” & “Long Term” & “Investment” LIVE trade datasheets & spreadsheets

Access to ALL current Paid Subscriber Substack Chats & live trades weeks before the Free Subscriber (You may need to log in as a free subscriber to see my chat.)

Occasional Founder Chart Examples

Founder Subscriber Benefits:

All Free & Paid Subscriber benefits.

Exclusive Founder Chat

Exclusive Founder Notes, delivered daily with explanations & justifications of my trades and investments.

Exclusive weekly & daily Founder Videos averaging 60 minutes with tedious labor and note-taking explaining every molecule of my highly advanced and precise trading decisions.

Exclusive priority & focus of my time at any point over Paid & Free subscribers.

Access to my “Live General Trade Plan” checklist.

Access to my Daily Routine & Psychology manifestos & regimens.

Automatically unlock ANY unlocked milestones, including lessons in developing bots, routines, scripts, indicators etc. for your trading.

Access to ALL Trading Scripts & Indicators I use.

Access to ALL Trading Drawings & Templates I use.

How exactly are you sharing trades if I am a subscriber?

Trade details are shared via screenshots in my Substack chat. It is essential to download the app or use the website and enable notifications. Screenshots include entry points, stop-loss, and target levels. These trades are then logged in my Excel spreadsheet. I recommend you create a similar spreadsheet to track and verify these trades independently.

This blog is supported by a referral program. You have two options:

Share with a friend via the substack app, and earn up to a year of subscription, free of charge!

Help promote and share the value of my content directly on substack or social media, as instructed below under “Earn A Free Or Extended Paid / Founder Subscription”. (Recommended)

Current Paid Subscribers/Founders: 0-9

Paid Subscribers/Founders Are Guaranteed a 94% Discount LIFETIME As Long As You Stay Subscribed.

Current Subscription Cost:

$409/m (0% Discount) (M/M Plan)

$25/m (92% Discount) (Y/Y Plan) Paid Subscriber Plan

$330/y (92% Discount) (Y/Y Plan) Founder Plan

$990 Lifetime Founder Access (92% Discount) (Y/Y Plan)

The pricing of this blog is automatic and based on a mathematical formula that weighs in performance over time of the trading as well as the number of subscribers. It is possible for the subscription cost of this blog to go to 0. Literally. Either the data backs it up, or no cost.

The Formula:

We operate with the assumption, that most median families can afford to loan or save up to an account size of $25000. If we then also assume it is possible, even with a full time job, to follow at least 20% of the trades, we now have a formula and a basis for tracking expected performance with a demo account. I chose to charge a subscription price of 15% of an expected return of a $25000or €25000account, but of course, accounts higher than that will be charged less than 15%.

The expected profit, needles to say, would grow the account to over $1000000 in 12 months, risking just 0.5% risk per trade. See the full table for how I am pricing my subscription, below:

To fully understand how my pricing model works, please read this blog and thoroughly study the calculations on my subscription pricing spreadsheet, via the button below:

Once you are subscribed, the price will never go up for you. Only down, for as long as you stay subscribed. Stay updated with payment information.

Blog Goals & Milestones

In my spreadsheet, you will find a section called “Goals & Milestones” - if you are already a discounted paid subscriber, you can benefit from helping me as well by commenting & sharing my work. The more paid subscribers I have, the more content will be unlocked.

Very much appreciated.

Before I link you my data, and now that you have read and understood my subscription pricing model, I want to understand “why” data is important. I just released this blog so you can get a basic overview of how and why I use data in my trading. It does ALSO contain Founder content:

Expanded Trading Performance Data

Below you will find the snippet of my most recent all-time trading & investment performance summary, which I update here and other places regularly.

This data DOES NOT guarantee profitability in the future, and is solely a reflection of my mathematical profit model based on the data of the trade studies I shared. Acting on anything I share here is at your own risk, and the Disclaimer applies.

All my trading data can be found here:

Spreadsheet link:

Risk Per Trade: 0.25%

- All Time Trading Statistics -

💰 Starting Balance: 🟢 $10,000

💸 Balance Today: 🟢 $1,832,008

💰 Total Gain %: 🟢 11732.01%

🔢 Total Net RR: 🟢 2996

📈 RR Per Month: 🟢 104

🏆 Winrate: 🔴 43%

📈 Profit % Per Day: 🟢 14%

📈 Profit % Per Year: 🟢 4956%

🔢 RR Per Trade: 🟢 0.21

🔢 Profit Factor: 🟢 1.38

🔢 Max Drawdown %: 🟢 14.57%

📅 Trading Start Date: 01-08-2023

↔️ Trading End Date: 05-21-2025

____________________

With a bit of Python & Javascript, magic can be worked in google spreadsheets to condense and digest raw data.

These are the most important metrics that can be found in “My Audited Trading Data” - condensed into a nice little performance report. Of course ALL trades I have shared including their Tradingview links can be found in the datasheet, as well as their respective timestamps in my substack chat.

Eventually, I will be making ALL of my content here free for all. I will go into this at another time.

Let us break it down:

Balance Today. With a 0.25% risk simulation per trade, many times up to 2-3% risk per day, we see that over a 2.5 year period, $100.000 turns into $7.543.397. Respectable.

Total Gain %: A staggering, but not world recordly, 7443% return.

Total RR: 2020, which is great, but only if it beats fees (which I included in the calculation based on futures trading.)

Then we got RR per month, profit per day, etc. The most important to highlight here is that

Winrate: at 42%, we see that this metric does not really mean anything in terms of profitability.

RR Per Trade: 0.2. This is decent, but could be better. Ideally above 0.05 RR per trade to even remain breakeven.

Profit Factor: 1.4. This is quite good. This also factors in fees.

Max Drawdown: Below the industry standard max pain threshold of 25%, by having an all-time max drawdown percent of 14.57%, whose dates, peak and trough values etc, can be found in the datasheet.

Overall GREAT performance. Not perfect, though.

Earn A Free Or Extended Paid / Founder Subscription

I am running a promotion now, indefinitely. Every weekend, I will be giving out a free one week subscription or extend an existing subscription (Paid or Founder). Follow the instruction below, and you will receive a reward worth one week:

Free Subscribers: - Twitter / Facebook: Like, Comment AND Retweet ANY of my content, then send me a DM on twitter or reach out to me via my email in contact below. If you are NOT a paid subscriber, you will immediately be given one week free access to my blog. If you already ARE a paid subscriber, see below:

Theobeownsyasubstack@gmail.com

ALL Subscribers: - Substack: Create a free (or paid) account on Substack, log in, Like & Restack(Retweet) THIS POST FIRST (to join the weekly raffles going forward) and then complete the task below.

Every Saturday/Sunday, I will announce the winner of the weekly raffle. One winner for every 10 qualified participants.

To qualify for the raffle and win, you must simply complete the following task:

Task: Like & Restack(Retweet) This Post (link). Then, you must REACT with any emoji on my newest release of the thread “IF YOU ARE NEW, READ THIS” found here in this link. Lastly, you must comment on on one of my Founding / Free post, that is released directly on the blog frontpage here (link), at least once per month. Make sure you have liked THIS POST FIRST before entering the raffle!

If you shared, liked or restacked the announcement post of this raffle, your name will show up on the raffle spreadsheet below. There, you can see if your engagement/activity rating is high enough to qualify to win in the raffle.

The higher the activity rating, the higher chance of winning.

My Referral Reward Program & List

Substack also runs a referral program that you may like. Click this link.

How The Blog Works

Content is produced daily by way of sharing my personal journals, which can arrive in the follow formats:

Blog format. Nowadays, typically, I will be posting a blog or a video to summarize the trading performance of the blog over a period. Usually I would also comment on global trends, macroeconomics, politics & geopolitical shenanigans that can be associated with movement in the market. I would also share charts with general expectations for free, then also actual trade ideas for paid/founding subscribers.

Video format. This is my favorite format recently since middle of 2024. I produce videos for paid/founding subscribers, many times hours long each of them, containing all my tools and methods, chart drawings, thoughts, predictions, you name it, including many times managing trades and investments I shared, live, in those videos. They act as my own personal video-recorded journal.

For Founders, my videos will as mentioned contain all my charts, drawings and tools I use to predict and trade these markets. However, I do also share “Arrow Predictions” for Free / paid subscribers, where I do not place SL/TP/Entry Trades per se, but like any other guru on the internet, although I am not a guru, I simply, humbly, predict where the market will go WITH NO two scenarios. One scenario only. No vile hindsight shenanigans.

Green / Red arrows - >70% Confidence in edge.

Orange arrows - 60-70% Confidence in edge.

Grey arrows - 50-60% Confidence in edge.

I am obviously not predicting something that is less than 50% confidence!

The above DXY example is something I share in my “Daily Market Arrow Predictions” series, which are free, for now, but may at a later time than writing of this blog, be only paid.

Substack Chat. This is where ALL my trades will be posted. It looks like below. Each market/asset class has it’s own category and “timeframe” (short term or long term) so that each paid subscriber or founder can get the value they were looking for. I recommend you always put a notification on long term management, as I may manage short term trades there, too. Remember, as a free subscriber, you may need to log in to access it.

Watch the below video showing you, step by step, how you would be verifying my trades either as a Free or Paid subscriber, using the Substack website or Substack app (Android or IOS):

Note: Timestamps in the chat can be found both on Andorid, IOS & PC. PC by pressing the three dots “…” and you see timestamps even on messages that are replies inside a thread. Fingers does the work on smartphone.

In each thread, I might post ONE Tradingview screenshot, but it can contain up to 6 individual trade executions for that same Tradingview screenshot.

6 positions indicates more than 70% edge on the trade. Not winrate, but edge. By feeling, and many times by data.

Where 1 position would indicate something very close, but above, 50% edge.

10 Minute Guide: How To Verify My Trades And Results Are Real

+50 RR, 5000% ROI from Janaury 17 to January 22.

I also have a video of how my timeline typically looks like, including proving and showcasing real, live trading and investment examples, and how it’s documented:

I encourage Founders to read the below post to understand most of the important content in my charts that I share with Founders, as well as other tools:

Founders: The Basic Field Guide

The philosophy here is to quickly elevate any new founder up to speed to have some sort of understanding of the tools I use for my trading. Ideally you should start watching and reading my Founder content from the very beginning, but this guide should get you up to speed to have a modest ability to follow along, provided you listen carefully!

The Best Way To Follow My Trades & Get In Sync With Already-Posted Trades

Once you are set up with Substack, and you understand how to use the chat, and how to get notifications from a thread, here is what I recommend:

Look at what markets I perform best in. (See the data spreadsheet)

Look at what category is best (typically Short term)

What time of day would you be available to follow short term trades

If you do not like short term trades, should you just follow long term and investment trades.

You ultimately have to decide what is best for your time, and what data you like. I recommend you check my data every 3 months to asses.

Best Time To Follow My Short Term Trades:

Between 03:00 AM and 05:00 AM New York time. Entries after 05:00 I have less performance and risk normally. Ideal for Forex, not so much for equities.

Between 07:00 and 11:00 am time. Ideal for all markets.

After 11:00: Recommend ONLY equities.

Short term trades I might frequently manage, and you may have to be more present to follow those trades. Therefore, I recommend you pick one, or all, of the above time windows, and only the markets associated with them. Of course, you can follow as much as you want.

Best Way To Follow My Long Term & Investment Trades

It can be more difficult to get the exact entry, but I generally say, if the RR is still more than 0.8 on the RR for these trades, you are probably good. Long term trades may still have a shorter stoploss. Investment trades always have a wide stop. You can check Long Term & Investment trade entries in any “long term” thread, and these will be more suitable for you. If this is your preferred strategy, make sure you only allow notifications in this thread.

See the below post for an advanced understanding and full picture about how to get in sync with already posted trades and investment ideas, EVEN if you are late to take a trade:

How I Got Into Trading & Investing

I started trading, or rather began studying day trading and investment, in 2017. Crypto, Forex, Stocks, you name it. I have been in all the recent fomos and blowmos. I had my huge ups and huge downs. November 8, 2022, when FTX collapsed, for reasons and details unnecessary to dive into here, I wanted to start fresh and sound and decided to make this blog. Lets be clear: This service is exists strictly for the purpose of 1) Higher quality of holding myself accountability through a public journaling domain. 2) As a secondary source of income. 3) As a medium to share all my trades, investment, and all thoughts between Heaven and Hell, to avoid repeating and replicating conversations over and over with friends. There will be no Lambos here, just macroeconomics, philosophy, trading & investing at highest grade and purity.

So starting January 1, 2023, I decided to share my private trading journals with the world, in a free and a paid format, as well as with a fresh mind and fresh “fake” account to document everything with.

My Trading Strategy

As mentioned earlier, if you want to follow along with me day-by-day, cycling in and out different tools, indicators, scripts, data tools & AI tools, you would have to become a Founder. I release multiple Founder videos every week, each being many hours in length, much information to dwell and consume.

However, I released a blog that explains the overall approach and strategy that I have evolved throughout my 8+ years in trading in the video below:

All trades are tracked and shared live and will be logged in the spreadsheet, see by clicking button below:

You can find ALL my video recordings released on substack, organized on this spreadsheet:

For the rest, please find any FAQ attached to emails or below, answering any other questions.

Important Links

Trade History & Verified & Audited Trading Data

(Founder Only) Trading Plans & Analysis

(Paid Subscriber Only) Live Trading Data Collection

All Previous Founder Analysis Posts

All Previous Arrow Posts - Free Market Analysis

F.A.Q

How do I trust the trading and investment performance data you have shared?

Start tracking and verifying the trades I post BEFORE trusting me. My chat as of 2025 has been made free for all. Go into my (Substack Chat) and find all my trades from any asset class you like. Note the timestamp and the TradingView link, and find the EXACT corresponding one and the result in my spreadsheet dataset (My Audited Trading Data) and see what I claim matches exactly what was posted in the substack chat. Note, that any reply I make in a chat thread CAN’T be edited, so there is no cheating, and deleting would be called out by my horde of followers & subscribers.

I highly recommend and encourage you, if you are not a paid subscriber, to choose the “7 day free trial” and open my substack chat (on app or webpage) and verify the trades I posted myself in the spreadsheet, with the ones in the chat. That way you can see that all trades are posted live and not edited. At the present moment, I can’t make “paid subscriber” chats available to free subscribers, but this is a feature I will be working on getting implemented by the substack team in the future.

The usage of this blog's information is at your discretion. You can follow along, subscribe, or even become a founder. I recommend downloading any MetaTrader 4 platform on your desktop or mobile device, or even using a futures broker, and opening a DEMO account with fake money. This allows you to simulate trading alongside me. For guidance on using MetaTrader 4 and placing demo trades, you can find tutorials on YouTube. Any broker is fine.

Substack chat link:

Spreadsheet link:

In my substack chat, I will be posting my trades in category/threads with a name of the market and the date. I recommend you make a tab on the website or in the app to follow as many markets as you like, and refresh automatically.

Every month, I will post threads in my substack chat that you can click the “notification bell” on inside. Example:

EURUSD Long Term - December

GBPUSD Long Term - December

EURUSD Long Term - December

General Notes: December

Chat: December

Inside each of these chat threads, click the notification button to follow trades of that asset class for a month or that market/symbol. I will be creating a daily delineation date inside these threads every time there is an update for that market. It will keep things way more organized.

Please only post messages in the “chats” sections thread, and post questions in the Q/A thread. Whichever date doesn’t matter, I usually create them every day. Alternatively, join my free telegram discussion group.

“General Notes” do not post/comment anything in there.

Do not post anything inside a chat that is related to a market.

Once I have created a thread, all trades and updates relevant to that market will be posted in that thread. Simply react to my thread, with a thumps up, a heart, for example, and you will now be following that thread and receive the usual substack chat notifications for that thread. This is my most recommended way to make sure you follow all my updates and ONLY for the threads/markets you like. If that does not work, use the “bell” on android/ios in upper hand corner to “turn on reply notifications” for that specific thread.

Tradingview screenshots with stoploss set 15m & above timeframe = Long Term

Tradingview screenshots with stoploss set below 15m = Short Term

Why are you charging money for your trades and analysis, when so much online is free?

It is true, most content out there is probably skewed at best, and highly malicious at worst, of what is related to trading and investing at least. Why am I different? Well, I do not claim to be profitable or guarantee any returns. As has been and will be mentioned many times during my blog: I share trades with a live timestamp, track them in a datasheet, then reveal the data. I believe this data is worth what I am charging, should you want live access to my trades or to my journals. The pricing is based on what the expected performance of the blog is plus a strong discount, and NOT relative to what other similar services are charging. My entire system is publicly available on my google spreadsheet (see above link.)

Do you trade / stream live?

Sure. I stream sometimes on my youtube/twitch, including live trading shown on stream. I attached an example below, I always upload my recordings from youtube on Substack, as well.

LIVE Trading EXTREME Volatility On Gold, Silver, Nasdaq Futures & Forex

Live Analysis Recording (Founder)

How do we know the trades are not fake?

Transparency is key in my process. I maintain a live Substack Chat and a public Telegram group where I post all trades, which are also logged in a synchronized Excel/Spreadsheet for verification. Substack does not allow editing of posts, which fully ensures transparency and accountability. With an active and observant readership, any discrepancies would be quickly noted and detected by a reader. I have never deleted a trade post.

I have gained a substantial following. Deleting trades on Substack or in the spreadsheet I could risk getting called out for. I have not deleted any trades.

What if I can't keep up with the frequency of your posts on Substack?

You do not need to track every trade to benefit from following along. Focusing on one trade per week or even per month can be sufficient. I post the market name for each trade to facilitate easy searching. Subscriber-only blogs provide additional ideas and potential trades not yet actioned.

Your trades are too fast for me to copy as a subscriber with fake money. What do I do?

Market-specific trading durations vary:

Crypto (e.g., BTCUSD, ETHUSD): Trades typically last over 12 hours.

Indices (e.g., S&P 500 ES, Nasdaq NQ, Dow YM): Often under 20 minutes.

Forex: Usually under 20 minutes.

Commodities: Around an hour or more.

My BEST markets are EURUSD and ES (Short term trading.) since Jan 1, 2023. They are good to follow. The data is in my spreadsheet. You can find all my data of long and short term trades for each market/symbol and follow exactly the ones you like. Refer to my blog google spreadsheet for all the data.

Choose the markets that suit your availability. Even if you enter trades slightly late, a 20-minute window can still offer viable learning opportunities with at least 0.5 RR.

You can use CTRL+F In the substack chat on the substack website or in the substack app (Android + Apple) then search for the markets you want to follow. Example search: “EURUSD” or “EURUSD Short Term”

Note: For longer-term strategies, refer to my blogs and crypto trades which are designed for extended durations. Only paid subscribers will see my executions. In Substack Chat, search for “Long Term” or “MegaTrade” to study longer term ideas, or when they are posted in the blog.

How can I follow or copy your trades as fast and as similar to your shared trades, as possible?

Clarification: I do not recommend you try to follow all of my trades exactly at the time I post them, but if you do, the best is to make sure you have access to my spreadsheet where I post them live (with the link) and set up an auto-refresh for that google spreadsheet. This is a separate spreadsheet where I keep track of the trades, before they are posted on the blog data spreadsheets. In there, or on the substack chat, you can follow my trades as close to live as possible. Do not forget to enable notifications.

Below button you will find a link to all my short term and long term positions currently open, as they are currently. IF YOU DO NOT have access, contact me on substack. You must be either a Paid subscriber or a Founding subscriber to have access.

I also, for all the Founders, have a spreadsheet for all Trade Plans & Notes I keep doing the day/hours:

Why do you post videos as “volumes” or “lectures” and say it is not teaching? Are you not teaching that way?

A teaching would indicate something is “final” or “fully understood”. I publicly advertise that I am a student of financial markets. This does not mean that me teaching does not have value, but I want to be clear that I am ONLY sharing notes and I am not trying to teach something that is taught by me or someone else as “final”. I am simply sharing my notes and journals for Founders so they can see exactly what I see, and think what I think. That is all. No per-se teaching and I want to make a disclaimer here that any future “teaching, lecture, video, volume, blog” by me talking about something is ONLY relevant to that time or day and is not representing anything I say, do or think in the future, although it is highly likely similar.

CFTC Required Disclaimer: All views and opinions expressed in this blog are solely my own and are presented for educational purposes only, without the use of real money. All strategies, methods and concepts used by me, may one day, and suddenly, stop working. My weekly & daily studies may touch on subjects such as Futures, Stocks, Politics, Bonds, Forex, and Cryptocurrencies. I strongly advise against taking any real financial risk action based on this content. Engaging in trading involves significant risk, and trading on margin can result in total loss of capital. You are solely responsible for your decisions, actions, trading, and investment choices. The blog’s contributors, including owners, writers, authors, moderators, and any mentioned entities or individuals, are not affiliated with any securities broker-dealers, investment advisors, or any regulatory authorities in the U.S., including the CFTC or the Securities and Exchange Commission. By reading this newsletter/blog, you explicitly agree to these terms. Any images or charts posted here are credited to TradingView & ForexFactory. All content on this blog is the intellectual property of the author. Do NOT share or copy any of the content on the blog without authorization from the author.

Privacy Notice: By participating in the various forums of this blog, substack chat, commenting, liking, restacking, retweeting (if on X), emoji-reacting, chatting, private-messaging, you agree to the following terms and may be subject to having your name revealed on my youtube streams, videos or on my substack posts and videos. I will NEVER share/disclose information about your subscription status, but the substack chat, comment section & any communications tool associated with my blog is considered a PUBLIC domain, and I reserve the right to share names of members in my content should they be present in any of the aforemetnioned public domains. I appreciate all the participation, though!

The blog on this content is intended for people aged 21+.

About Theodor: I am a student of financial markets and economics. The content of this blog is intended as a personal journal and should not be considered as financial advice or recommendations. I do not claim any profitability or likelihood of successful trades, nor is it my intent to promote a signal service. This blog is a tool for educational enhancement, allowing you to form your own judgments on its usefulness for your investments and trading activities.

Blog Integrity: The analysis, calls, and trades discussed in this blog will not be edited post-publication. I encourage you to track and verify each call in real time to gauge the accuracy of the information presented. The Substack chat, which features live and uneditable content, ensures transparency and honesty in all discussions.

Usage of Terms: The term “trade” is used strictly in an academic context, referring to hypothetical scenarios that could theoretically represent real trade setups. It is not an encouragement or incentive for you to execute any trades.

Stay Updated: I regularly post updates on Substack Chat, Twitter, and Telegram. Please follow me on these platforms to stay informed, especially on Substack Chat where I share specific guidelines for educational purposes based on blog analyses.

Contact and Further Engagement: You can direct message me on Twitter and leave a comment on this blog. I do not accept direct messages on Substack. Additionally, consider joining my announcement and public discussion groups on Telegram for more frequent updates and discussions.

Theo

My Announcement Telegram:

My Telegram PUBLIC Discussion Group:

All wallpapers used in the blog, credit goes to ChatGPT4 & : Imgur

My Social Media:

Thank you for everything you do bro