Data - The Cornerstone Of Profitability

This blog will be edited as I add/remove Data relevant tools and indicators from my strategy.

Alright folks.

Out of necessity, I am going to (earlier than anticipated) release the sources and tools I use as it relates to DATA.

To my knowledge, there is not a SINGLE long term, consistently profitable, not capitulated: trader, investor, speculator, gambler, who does not know their data. In the online social media space, by FAR, more than 95%, of communicators, gurus, mentors, influencers, all promote and talk about markets, cryptos, stocks, as if they know anything at all, without sharing, let alone even haven performed, a historic dataset they can rely on to even contemplate the outcome that is profitability. The reality is that most these entities and individuals, are in fact not profitable at all. Who can one asserts ones professionality or profitability in trading/investing/speculation, without knowing their historic numbers, expected standard deviation templates, and what not?

Let me clarify in more simple terms what I mean.

Imagine you are a tech enthusiast. You buy bitcoin in 2017. You make a million dollars with a takeprofit in 2024. Now you go on twitter and start babbling about crypto, as if you know anything, as if you are now a professional crypto investor or trader.

Unveiling the bombastic self promotion, your underlying data screams it all:

Trades / Investments: 1.

Winrate: 100%

Profit: $1.000.000

Looks pretty good, doesn’t it?

Wrong.

Let me ChatGPT it for you:

This dataset is highly inconsistent for evaluating a trader or investor's long-term performance. Here’s why:

Sample Size is Too Small – A single trade or investment is not enough to determine consistency. There’s no evidence of sustained performance over time.

Win Rate is Meaningless – A 100% win rate over just one trade tells us nothing about skill, risk management, or strategy effectiveness.

Profit Looks Great, But… – Without knowing the initial capital, risk exposure, or market conditions, this profit figure doesn’t provide meaningful insights.

No Risk Assessment – A key part of consistency is understanding drawdowns, risk-adjusted returns, and volatility, none of which are present here.

Verdict:

This dataset cannot be used to evaluate consistency. You’d need a larger sample size, risk metrics, and long-term results to assess a trader’s reliability.

The profound advantage of being a trader, with multiple traders per year, is that you can accelerate the number of decisions you make, and in turn, the number of datasets for your trading.

You MUST collect and save this data.

A trader who does not collect data of their trading not only loses their edge and mathematical understanding of their performance, you also are infinitely more likely to lose long term.

Take same bitcoin trader, whose confidence is now through the roof, promoting insane returns and skill on social media. Bitcoin has existed for 12 years. What if, Bitcoin, goes into an unprecedented, never before seen bearish market conditions, Maybe Bitcoin return below 10000 over the next few years, then what? How does this trader, who has only bought bitcoin, navigate that?

They lose.

And they do not lose the first $10000 they invested. They also lose the $2.000.000 they lost from affiliate links and influencing revenue.

The emotional damage will be 100x.

Personal Data vs Historic, Backtested Data

Now, if you’re an investor, you may only make 1 or 2 decisions per year. A very large part of the general financial space, perhaps he largest, works like this. Your grandmother might have 401ks, and be passively invested in a bond/stock portfolio that is rarely tinkered with.

Your personal data will very unlikely gain a substantial dataset to draw any conclusions. In this case, you would have to rely on historic, objective data.

This is going to be KEY to understand why expected investment returns for Bitcoin can’t simply be black and whited as expected returns in say the stock market, gold market or bond market, can. Now let me be clear, I am not saying you can ever trust your data, as market conditions can change. Market conditions of a type and category, that only sees change every generation. Which currency is the flagship of the world? Which asset leads inflation? Do we still need oil? etc. When generational changes happen in the world, related to questions such as these, you effectively RESET any personal or objective historic datasets that relates to these markets.

Now, the good thing about the stock market is that it is, for as long as Free Markets exist, even if the US collapses, universal very likely for a very long time to ALL countries and ALL major sovereign stock indices, UNLIKELY to dramatically change.

There will likely always be jobs (Unless AI in 50-100 years?)

There will always be dividends.

There will always be international competition.

Or at the very least, we can assume robustness in this idea to be fact for many, many years to come.

If the stock market disappeared tomorrow, the world would catastrophically collapse.

If Bitcoin disappeared tomorrow, Michael Saylor would have problems. And the world would go on.

This is not to say that you can’t trust any objective data in Bitcoin, otherwise I would not trade it, but you need to be extremely careful when you’re trading it, and understand it’s correlations to markets that DO in fact have a much more logically robust and GENERATIONALLY old historic dataset. Such as the American stock market.

That is why an investor, with zero trading experience, can study the stock market, understand its intrinsic and infinitely deep threading into real world mechanics, and backtest and know that decisions made in the past 100 years, can lead to an outcome. Such as the expected 8-10% average return per year.

Now this is not something that turns 4 digit accounts into millions in a couple of years, to which no one has a real interest nowadays in such data or strategies especially if they posses male genitalia and below 40 years of age.

I am much more likely to take a non-experienced trader with a low dataset seriously, if they are primarily engaged with stock indices or individual stocks, understanding fundamentals, claiming any profitability absent personal historic data of profitability.

I am very unlikely to trust a bitcoin “investor”, claiming “investment” returns in the future based on a small dataset of individual decisions and in a market whose disappearance would not even remotely impact the world. A 12 year old asset class with no threading into the real world, except some money laundering and user autonomy over funds (real things of course but not quintessential.)

I hope this provides some common ground for us, understanding WHY some markets have objective data, and why others don’t. WHY what market you trade determines what kind of data, you need.

Asset Classes with a SHORT lifetime (Less than 25 years existence)

Operates with the following criteria:

MORE Personal Data

MORE Intraday Data

LESS Historic Data

LESS Fundamental Data

LESS Seasonal Data

LOWER Timeframe Focused Versus Higher Timeframe

Asset Classes with a LONG lifetime (more than 50 years existence)

Operates with the following criteria:

Has ALL the benefits of shorter lifetime assets

MORE Historic Data

MORE Fundamental Data

MORE Seasonal Data

HIGHER & LOWER Timeframes Can Be Used.

Where Personal Data would be based on your personal statistics and trade history. Sharpe Ratio, Sortino, RR per Trade, Number of Trades, Profit Factor, Wirnate,e tc.

Where Historic Data includes hypothetical backtests with personal data, objective measurements of expected profitability per year, typical range to form a top in bull market, bear market, etc.

Where Seasonal Data looks at profit during what months, days, weeks, years. Cyclical data. Hurst, Time.

You see what I am getting at.

I am of course going to remind you of how I personally collect personaal data (which is not historic data, but I talk a bit about that in the blog below. Let me link both here:

Lets Look At Some Key Metrics In My Personal Trading Data, That I Share For Free.

Now, with the link above, lets look a bit at some data.

Basic Data

Seasonal Data

Asset Class Data

Obviously could be arranged better. And some of these numbers can be ignored (like the Account Today, which I mostly included to show how catastrophic liquidity constraints and fees are on your trading.)

1. Average RR Multiple.

This tells me what is my expected return per trade (absent fees.) 0.19 is good. But below 0.1, while still profitable, could indicate more of a breakeven nature, given fees. Depends on market, platform, slippage, etc.

Winrate %

Absolutely useless metric. Anyone promoting winrate should be red flagged. It doesn’t mean anything.

Profit Factor

Very important metric. And we can even see, the profit factor I have is higher in my max 10k$ per trade and included fee simualtion. 1.44 profit factor gives a better understanding of the strength of net monetary wins vs losses.

I am not including sharpe/sortino here, but maximum drawdown is important. Calculating this would require 10 more rows and spaces which would stabilize my spreadsheets even more, so for that, I simply look at the chart. And I am not worried.

(Except the "green” simulation that is chaotic.)

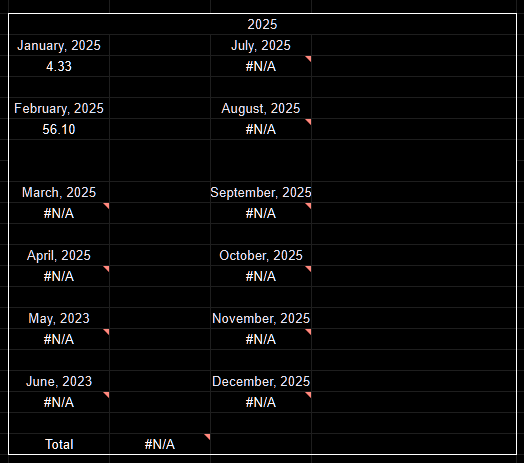

Further down, we can look at my personal seasonal data.

While 2 years of data hear is not very telling, I also know form experience and past data, that January-February is more difficult/breakeven for me. If I were to calculate RR per trade in those months, I would be breakeven. Surprsignly I have had goo experience with December, while September-November historically are my best months where compounded returns are absolute.

And lastly, while we have other important data, for the sake of this version of this post, I will be ringing in my asset class data:

While I also have a last 3 months data, we can see here that my RR per trade is quite high for EURUSD, GBPUSD, and ES, where ES I ahve the highest return. My NQ barely makes breakeven, if we consider less than 0.1 is potentailly risky in fees. Oil, Gold a bit so, and Silver looks good, but only 145 trades, so my confidence there is soft. ETH and BTC I also shoot higher returns, which has been remarkable considering how much I hate Crypto as a trading asset.

EURGBP is a disaster.

If I was a follower of my work, I would stduy EU, GBP, ES, NQ, which has VERY higher (500+ and 1000+) datasets of trades, while I would be cautious studying my Oil, Gold, and silver trades (considering Gold is a silver correlated marekt) and I would also be interested in my crypto trading, given 0.2 RR per trade with 674 executions is great.

I hope this provides some insight into how my personal data works, and perhaps how it could be structured for you, as well. I am missing some metrics still that could be helpful, I could structure it better, but overall, the picture is pretty clear: How the F*** do you know if you are winning, and why on earth are you on twitter sharing any opinion about markets, if you are not sharing these numbers? Shameful, if you ask me.

Now, lastly, below this last paragraph, I will for Founders share some of the tools I use for objective data in the markets, which third party tools I believe provide a very useful edge in the markets. While the content of my blog is intended to be delivered in a way where followers, Founders, will slowly learn and adopt just by way of how I do notes for myself, I find it necessary to expand a bit on some of these third party tools

ONE: Because they are third party and I must promote them (and get permission) to have legal comfort

TWO: Because sometimes I do not always show the visual source of the information, and you may need to have the option to look it up yourself.

Lets go.