Trading Performance Report

ATTENTION! - If you are new, YOU MUST start here (link below):

Introduction & Guide: "Tracked & Timestamped"

You will NOT understand the context of my analysis and support & resistance levels, without.

Congratulations to “Matt” who won the raffle this week (link) and has won a paid/Founder subscription value of 7 days.

➡️Watch All My Previous Daily Market Support & Resistance Arrow Predictions Here

All-Time Trading Performance Report

➡️ See Full Data Here: (Click Link)

https://www.theobeownsya.substack.com

Risk Per Trade: 0.25%

- All Time Trading Statistics -

💰 Starting Balance: 🟢 $100,000

💸 Balance Today: 🟢 $11,832,008

💰 Total Gain %: 🟢 11732.01%

🔢 Total Net RR: 🟢 2496

📈 RR Per Month: 🟢 91

🏆 Winrate: 🔴 42%

📈 Profit % Per Day: 🟢 14%

📈 Profit % Per Year: 🟢 5197%

🔢 RR Per Trade: 🟢 0.20

🔢 Profit Factor: 🟢 1.38

🔢 Max Drawdown %: 🟢 14.57%

📅 Trading Start Date: 01-08-2023

↔️ Trading End Date: 04-11-2025

🗃️📋 Preliminary Notes 📋🗃️

Trimester Quarterly Close + Monthly Close on the week, so month end rebalancing & other shenanigans.

Non farms & Wednesdays PCE data will be key econometrics for this week

May speculate some of the PCE and NFP data outcomes a few hours before release.

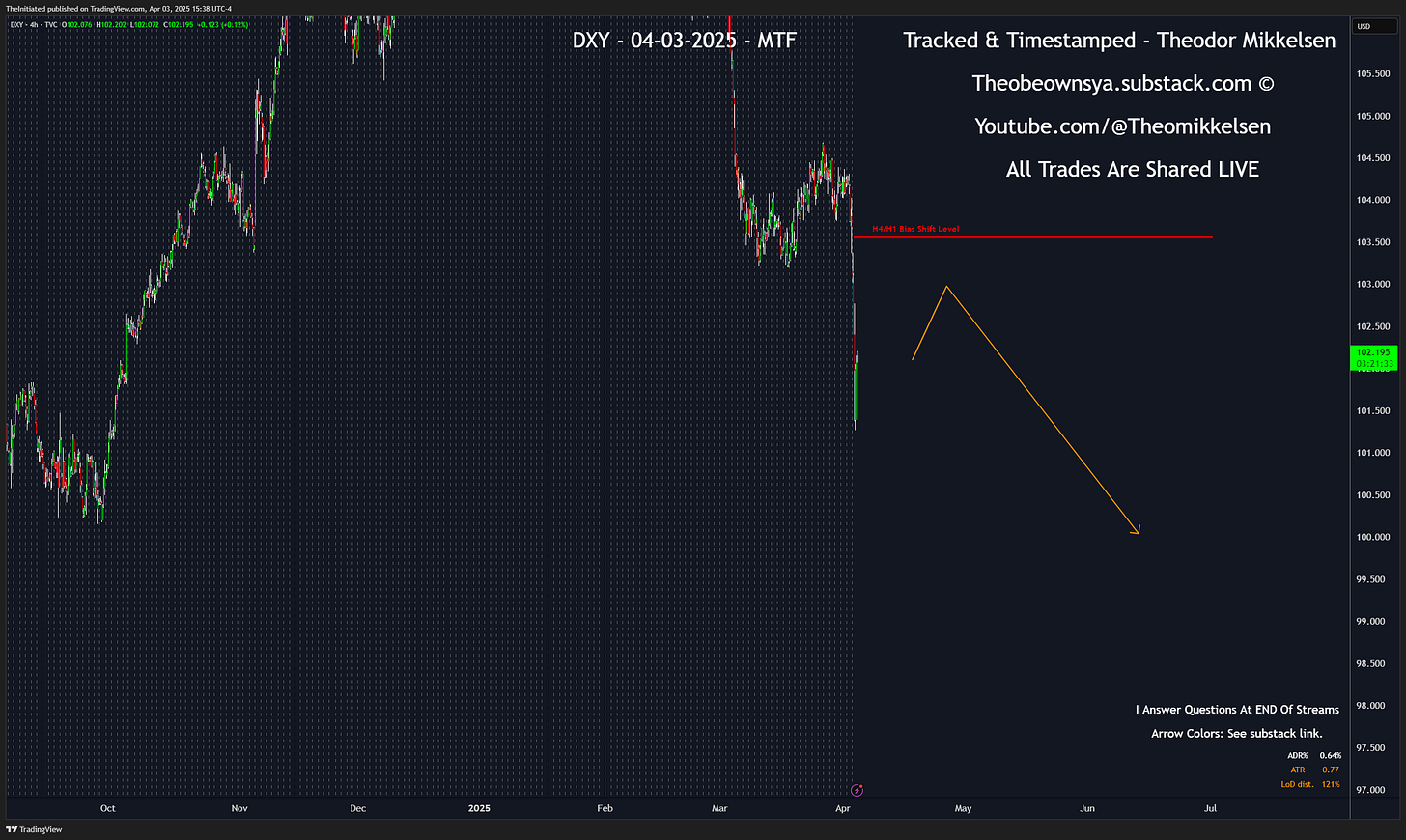

💵 💶💷 Forex (DXY) 💵💶💷

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

SHORT TERM VIEW:

Key Dollar Index Support & Resistance levels: (TVC)

DXY - Long Term Bullish Above🟩N/A

DXY - Long Term Bearish Below🟥107.661

DXY - Short Term Bullish Above🟢98.362

DXY - Short Term Bearish Below🔴102.683

Please refer to these for EURUSD as well as forex.com data

Please read the notes on Forex in my previous Arrow blog.

04-27-2025 - The USD is possibly going to be more volatile than the stock market, unless we start giving up my levels as I will appoint below. This will also be hugely factored by my predicting of FED cutting coming up in may, and I think the deterioration of the currency also will be associated with the negative Sentiment from key US allies being put upon the administration, as the dislike for the bombastic in-and-out executive orders have shocked the world. Whether I am right it goes down, is left to see.

📉📈Stocks & Indices📈📉

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

SHORT TERM VIEW:

Key Stocks & Indices Support & Resistance levels:

ES - Long Term Bullish Above🟩4960

ES - Long Term Bearish Below🟥5692.75

ES - Short Term Bullish Above🟢5375.25

ES - Short Term Bearish Below🔴5692.75

Please refer to the current front contract on barchart.com or Tradingview.com

Please read my previous free Daily Arrow blogs to understand how I have called the market, live.

04-28-2025 Very good longs have been shared and traded line based on the lines drawn here.

I expect consolidation between my levels unless broken.

⚡⛽Energies⛽⚡

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

SHORT TERM VIEW:

CL - Long Term Bullish Above🟩 56.07

CL - Long Term Bearish Below🟥69.00

CL - Short Term Bullish Above🟢60.24

CL - Short Term Bearish Below🔴69.00

Please refer to the current front contract on barchart.com or Tradingview.com

I think we should see Oil trade higher longer term here. We had the predicted run lower take place, making our calls correct., Now, we shall see if we can muster the next expected move, which is up.

04-28-2025 Not preparing any new expectation here. A little unclear on the short term.

🥈🥇Metals:🥇🥈

Chronological Screenshots Shared In Last 4-8 Blogs:

Key Gold GC Support & Resistance levels:

GC - Long Term Bullish Above🟩N/A

GC - Long Term Bearish Below🟥N/A

GC - Short Term Bullish Above🟢N/A

GC - Short Term Bearish Below🔴N/A

Please refer to the current front contract on barchart.com or Tradingview.com

04-20-2025 - I will be posting an analysis on gold if I manage to get to do it on time, editing this post. For now, I think it looks bullish at a first glance.

04-28-2025 Status Quo.

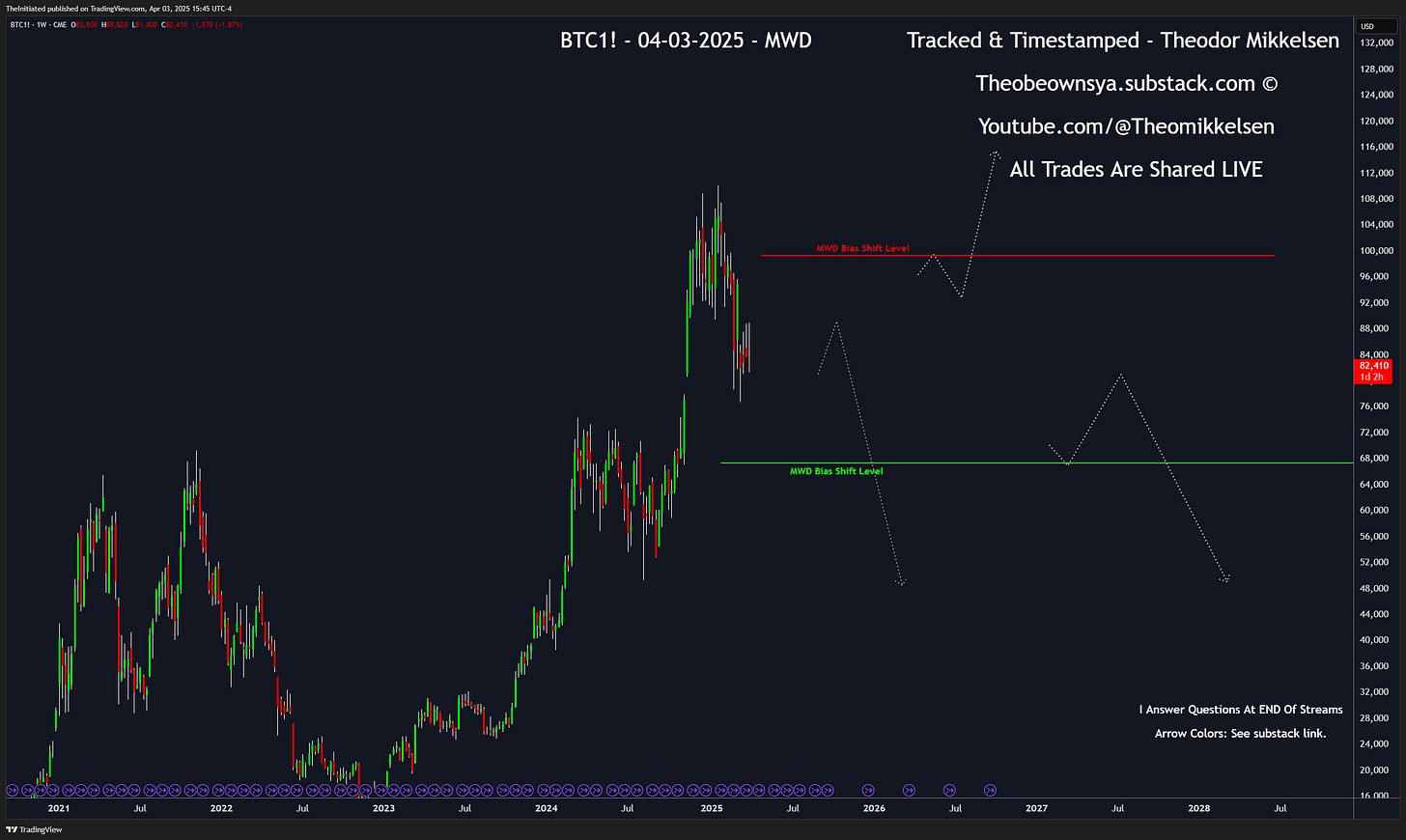

🗑️💩 Crypto 💩🗑️

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

Key Bitcoin Support & Resistance levels:

BTC - Long Term Bullish Above🟩84450.37

BTC - Long Term Bearish Below🟥N/A

BTC - Short Term Bullish Above🟢84450.37

BTC- Short Term Bearish Below🔴N/A

Please refer to the current front contract on barchart.com or Tradingview.com & Binance

04-28-2025 - I subtly believe bitcoin should continue higher, as long as we maintain the combined Long Term and Short term level. We have been trading it very succesfully.

Long Term Levels: An emphasis on Macro economics, Monthly, Weekly and Daily timeframes. “MWD Bias Shift Levels”

Short Term Levels: An emphasis on economic releases, with Intraday charts on H1, 15m, 5m, 1m.

Intraday Levels: Become a PAID Subscriber.

Many of the views & opinions shared in this free blog is based on my much more advanced and in-depth analysis from my Founder content. I do NOT check for typos! This post may be edited to ADD content but NEVER DELETE trade-specific content

Thank you for taking your time reading and watching my content. I would appreciate if you would like/retweet/restack/comment to motivate and improve my production quality.

If I have time, I will comment on Crypto, Oil & Metals before tomorrow Monday, otherwise stay tuned in my General Chat and I will share as I see something. Crypto has been overwhelmingly boring and I may not be interested in it until something triggers.

My general market watchlist includes:

EURUSD, GBPUSD, Gold, Silver, Oil, SNP 500 , Nasdaq, Dow Jones, NQ/ES/YM, Bonds, Dollar, Commodity Futures and Crypto.

I share my general plans by way of arrows, which are based on the analysis I share in the Founder analysis videos. All my subscribers have access to these plans, but there is no guarantee I will be around to trade these plans in all my markets, so even if I miss a trade, it can be of use to you. For more precision, follow my live executions with a paid subscription. 7 day free trial is open.

If you want to see me execute trade ideas based around these trade prediction arrows, I highly recommend you become a paid subscriber. 7 day free trial available. If you want me to show you the analysis that justifies how I can predict the markets like this, I recommend you become a Founder.

Theo

Disclaimer: All views and opinions expressed in this blog are solely my own and are presented for educational purposes only, without the use of real money. All strategies, methods and concepts used by me, may one day, and suddenly, stop working. My weekly & daily studies may touch on subjects such as Futures, Stocks, Politics, Bonds, Forex, and Cryptocurrencies. I strongly advise against taking any action based on this content. Engaging in trading involves significant risk, and trading on margin can result in total loss of capital. You are solely responsible for your decisions, actions, trading, and investment choices. The blog’s contributors, including owners, writers, authors, moderators, and any mentioned entities or individuals, are not affiliated with any securities broker-dealers, investment advisors, or any regulatory authorities in the U.S., including the CFTC or the Securities and Exchange Commission. By reading this newsletter/blog, you explicitly agree to these terms. Any images or charts posted here are credited to TradingView & ForexFactory. All content on this blog is the intellectual property of the author. Do NOT share or copy any of the content on the blog without authorization from the author.