Daily Market Support & Resistance Levels: Arrow Predictions

04-03-2025 21:30:45 - I Raise Your Tariffs With My Tariffs.

Trading Performance Report

ATTENTION! - If you are new, YOU MUST start here (link below):

Introduction & Guide: "Tracked & Timestamped"

You will NOT understand the context of my analysis and support & resistance levels, without.

Congratulations to “Eka” who won the raffle this week (link) and has won a paid/Founder subscription value of 7 days.

➡️Watch All My Previous Daily Market Support & Resistance Arrow Predictions Here

All-Time Trading Performance Report

➡️ See Full Data Here: (Click Link)

https://www.theobeownsya.substack.com

Risk Per Trade: 0.25%

- All Time Trading Statistics -

📅 Trading Start Date: 01-08-2023

↔️ Trading End Date: 03-28-2025

💰 Starting Balance: 🟢 $100,000

💸 Balance Today: 🟢 $7,993,688

💰 Total Gain %: 🟢 7893.69%

🔢 Total Net RR: 🟢 2355

📈 RR Per Month: 🟢 87

🏆 Winrate: 🔴 43%

📈 Profit % Per Day: 🟢 10%

📈 Profit % Per Year: 🟢 3557%

🔢 RR Per Trade: 🟢 0.21

🔢 Profit Factor: 🟢 1.41

🔢 Max Drawdown %: 🟢 14.57%

____________________

🗃️📋 Preliminary Notes 📋🗃️

I was brushing my teeth as I was going to let Trump “engage” the Tariffs that, to me, I had already drawn the expectation that everyone knew about. Sure I expected some movement, but I was not prepared for a 3x CPI juiced megamove like we saw, but they were luckily in favor of the predictions we shared in our last arrow release blog. Hurray! Please follow the chronological order of screenshots as they are released with each blog, and you can verify them from each blog, as well (and in the substack chat.) Nothing is deleted.

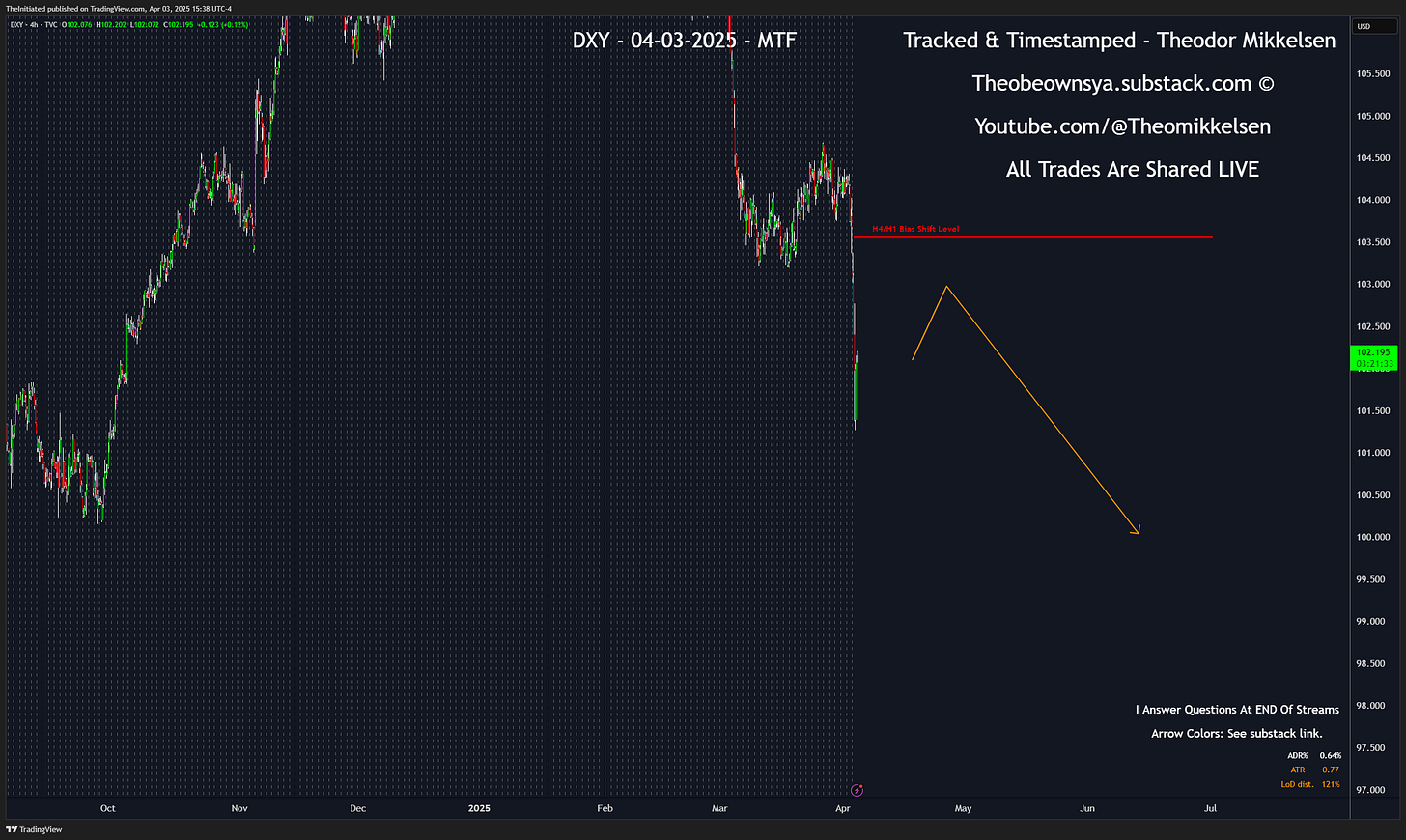

I believe with the introduction of the US tariffs, and oncoming retaliation, FED is now forced to act and show their hand. The simultaneous USD weakness we have had with a “collapsing” Stock market, now at the brink of limit down, gets me thinking that we are actually pricing in a potential rate cut. The rate cut will be necessary for US businesses to adjust to these tariffs in many, many ways better explained by someone higher than my paygrade.

ALL TRADES I have shared this week and currently have open, you can see them for free, here: Click This Link

Besides the standard watchlist markets I will be walking through nice-n-quickly below, I wanted to point out this week that I had shared some amazing trades on Cocoa & Cotton & Coffee as well in the commodities section. Coffee not as lucky, but boy oh boy yummy chocolate:

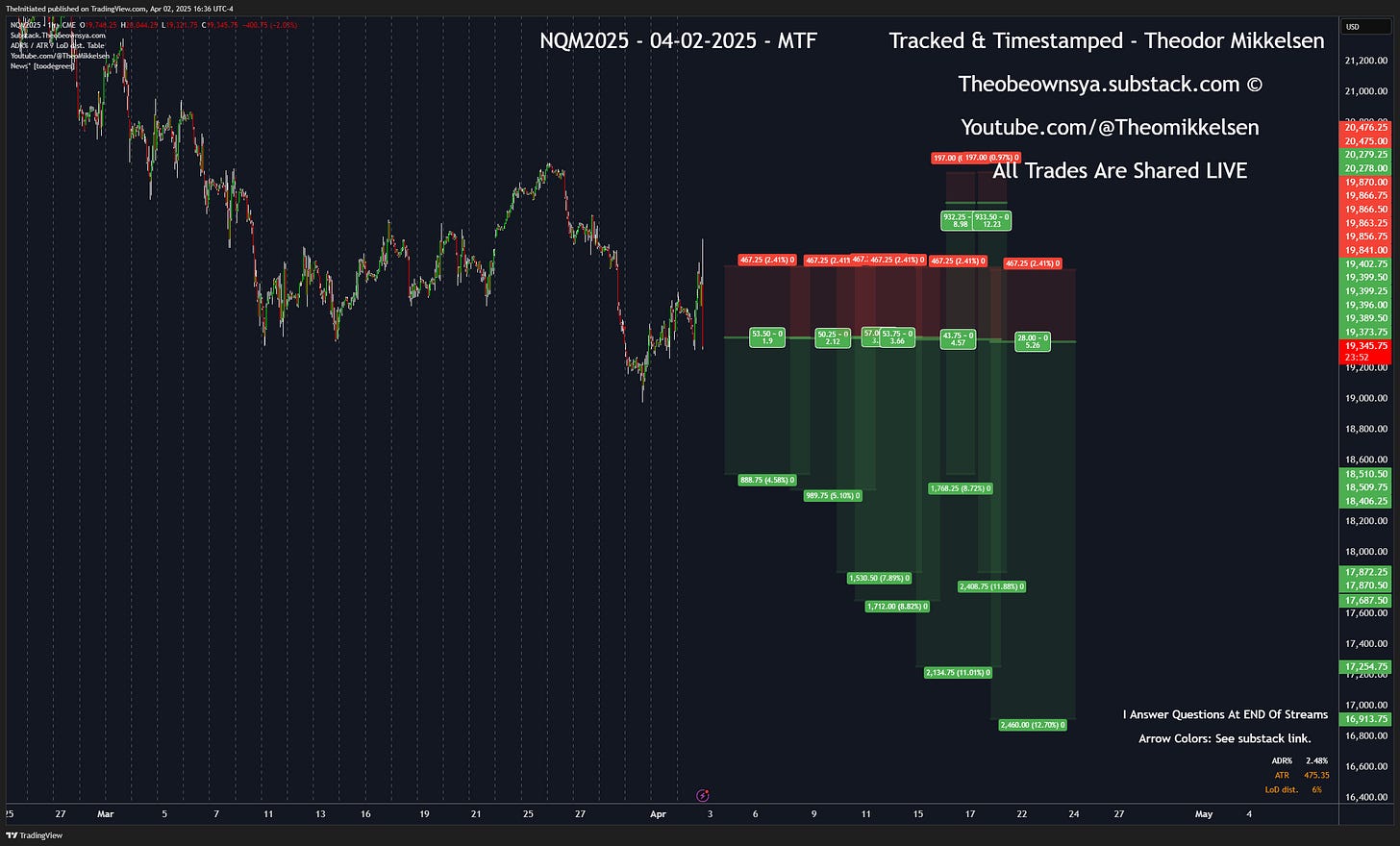

Besides that, I also shared longer term and investment term shorts on Bitcoin & Nasdaq, shared live in my substack chat for paid subscribers, and also in the spreadsheet for free, provided above. See them here, below:

💵 💶💷 Forex (DXY) 💵💶💷

Chronological Screenshots Shared In Last 4-8 Blogs:

Key Dollar Index Support & Resistance levels: (TVC)

DXY - Long Term Bullish Above🟩N/A

DXY - Long Term Bearish Below🟥107.661

DXY - Short Term Bullish Above🟢N/A

DXY - Short Term Bearish Below🔴103.569

Please refer to these for EURUSD as well as forex.com data

Please read the notes on Forex in my previous Arrow blog.

As you can see, the free content provided right here on Tracked & Timestamped, humbly spoken so, nailed the direction and precision of the Forex markets. Evidently so, it has become clear why and where the USD is going. I do not think this is related to the attempts to dedollarize the Dollar trade globally, despite the pessimistic globalistic political agenda overall, we will have to see how it responds with potential FED moves.

📉📈Stocks & Indices📈📉

Chronological Screenshots Shared In Last 4-8 Blogs:

Key Stocks & Indices Support & Resistance levels:

ES - Long Term Bullish Above🟩N/A

ES - Long Term Bearish Below🟥5773.75

ES - Short Term Bullish Above🟢N/A

ES - Short Term Bearish Below🔴5773.75

Please refer to the current front contract on barchart.com or Tradingview.com

Please read my previous free Daily Arrow blogs to understand how I have called the market, live.

03-29-2025 - I am going to walk through my predictions each week real quick:

On March 15, two weeks ago, I shared a bearish Long Term grey arrow. I am predicting a move back to the SPY level of 5000 (and similar, at the time of the March contract) - which is a huge psychological support in the investment and media world.

For March 19, I updated the medium term perspective, predicting a grey arrow that the market would go up, and then eventually come lower. At this time, my retracement bias was more flexible.

On March 23, I believed we should be more aggressive in our bearish bias, allowing no higher than 5880 to go lower.

AS EXACTLY predicted, March 29, we saw that my initial bullish bias for the week became later, bearish. Everything has been documented. EVERY blog: Daily Market Arrow Prediction series (scroll up for a link to all blogs) and all my trades, have been based on this analysis. Be mindful the grey arrow pointing up was from the BEGINNING of the week, and the top of grey arrow pointing lower became thee exact top. This was calculated prediction analysis.

To understand the Technical Tools and HOW I can predict these things happening real-time, a Founder membership will gain you insights into my extensive library of lectures and weekly analysis recordings just for that.

At the same time I had been going bearish around the top of my bearish grey arrow, I went in on ALL my accounts: Short Term, Long Term & Investment Term, then shared trades for all kinds of traders in NQ, and as you can see in the screenshot above AND in my data AND in my substack chat, I still have a few of those positions open - based on analysis I did DAYS before they were taken! I am excited to see results in my Investment term account, as the data there, needless to say, could use some fresh high RR returns! Patience is extremely key with these longer term timeframes and I share ALL of my data and trading. Not only do I share which category, short, long or investment term, my trading performance is best at, but also what markets. As a follower of my work, you can chose EXACTLY which markets you want to follow my trades, and which category, all based on publicly shared trading performance data.

04-03-2025 As can be seen, my prediction in the stock market has been pretty good, and I continue to hold longer term position there, as is shared for free, on my blog & substack chat. Admittedly, we traded outside my Long Term resistance level briefly during Trump Tariffs release, and I even had a couple of minutes of considering new and fresh bullish plans. Luckily, everything turned straight into the plan again and I could re-engage and share new shorts for the Nasdaq.

⚡⛽Energies⛽⚡

Chronological Screenshots Shared In Last 4-8 Blogs:

CL - Long Term Bullish Above🟩 N/A

CL - Long Term Bearish Below🟥N/A

CL - Short Term Bullish Above🟢N/A

CL - Short Term Bearish Below🔴69.52

Please refer to the current front contract on barchart.com or Tradingview.com

I was off and wrong in oil, i had expected the tariff outcome to send it higher. It joined a bit of a correlation one reaction on the Liberation Day shenanigans, and I suspect we are back to an idea of “go down to go higher” situation. The support level was broken swiftly, and I think we are going to see 65 and lower.

🥈🥇Metals:🥇🥈

Chronological Screenshots Shared In Last 4-8 Blogs:

Key Gold GC Support & Resistance levels:

GC - Long Term Bullish Above🟩N/A

GC - Long Term Bearish Below🟥N/A

GC - Short Term Bullish Above🟢N/A

GC - Short Term Bearish Below🔴N/A

Please refer to the current front contract on barchart.com or Tradingview.com

I did not engage Gold this week. I am waiting for information. Gun to my head, it is bearish. Feel free to check out my previous screenshots above.

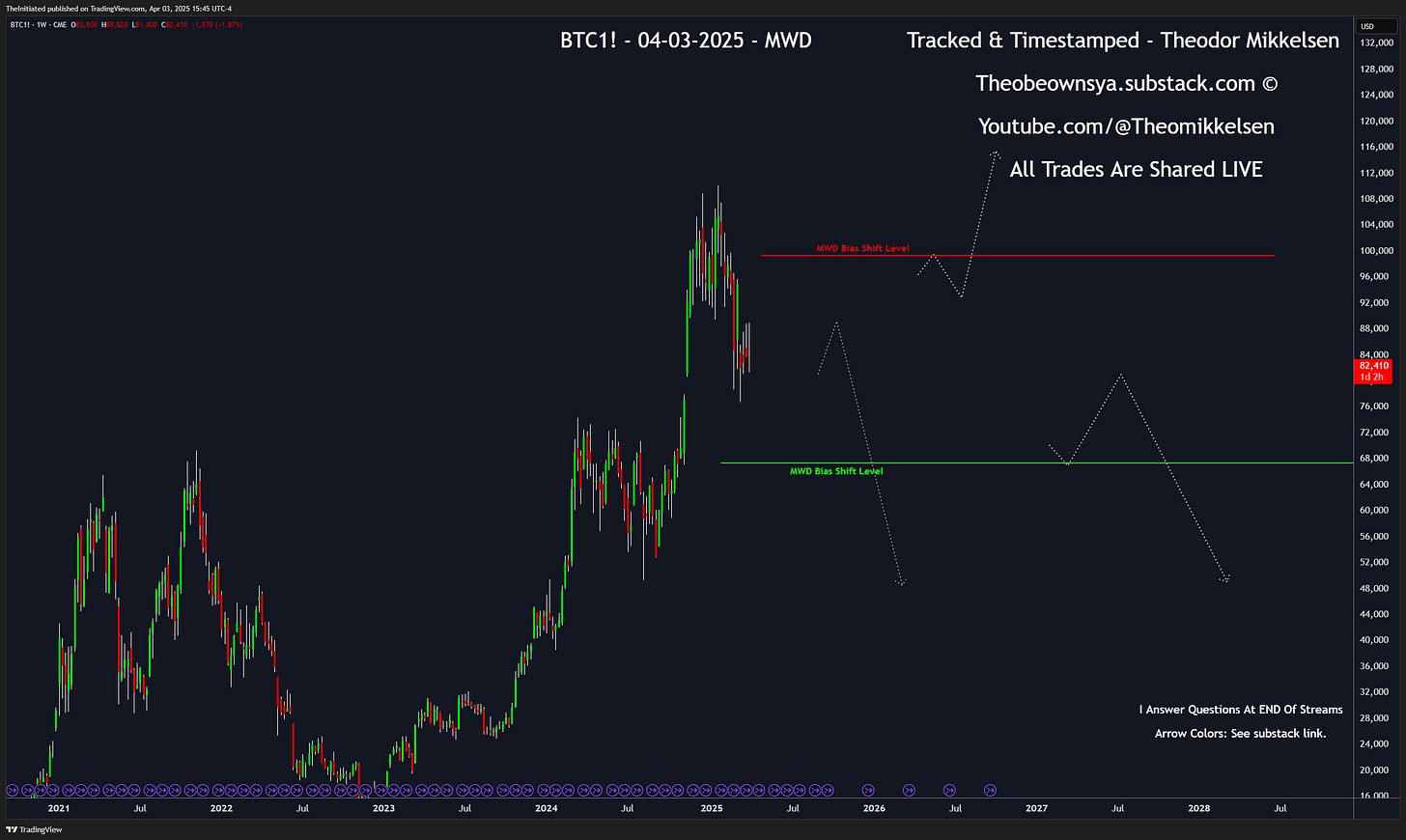

🗑️💩 Crypto 💩🗑️

Chronological Screenshots Shared In Last 4-8 Blogs:

Key Bitcoin Support & Resistance levels:

BTC - Long Term Bullish Above🟩67480

BTC - Long Term Bearish Below🟥87231

BTC - Short Term Bullish Above🟢N/A

BTC- Short Term Bearish Below🔴87231

Please refer to the current front contract on barchart.com or Tradingview.com & Binance

03-23-2025 The longs I had shared live in my 03-19-2025 post, all went to takeprofits. Where to from here, might the crypto reader ask? Hold my beer. Nothing has really changed from last analysis. levels remain the same.

03-15-2025 - Crypto is in an interesting position where we now have engaged a “pro crypto” US administration, with talks of creating a crypto reserve, and a dogecoin “pumpndumper” selling electric vehicles, despite absence from pumping lately on twitter due to managing 16 year old geniuses in the IRS, may at any point return to cause havoc.

03-15-2025- Sentimentally speaking, I believe the return lower is “classicly” a “crypto-bro” buy the dip. Saylor bullish, Hayes bullish, and Trump will save bitcoin and we can bypass sanctions right? I want to fade this obvious, “irrefutable” narrative, as what actually goes on should be the flipside of the iceberg here.

03-15-2025 - I believe Crypto, and especially Bitcoin, may finally start entering a stage of a never-before-seen “long term” bearish market, that, if alongside a correlation with the Nasdaq (as a beta tech stock correlation), could challenge the whole confidence in crypto as a whole. I don’t think we have historically, in last 12 months, had such sharp upswing from the all-time-high and then moving below 50k, so while the technicalities long term CAN go both ways right now, I think an idea of revisiting 50k, interests me.

With Gamestop announcing strategic buying of Bitcoin akin to Microstrategy, with a absolutely 1-to-1 bitcoin threaded or invested high-cap tech sector bleeding red, it became only natural to me to play some shorts (see the data and screenshot on Binance above) both on the Short term, investment term and long term. Full throttle. We can see on the current price, shared live with Paid subscribers, that the profit exceed 2 RR, and that is across 3 different account categories. Needless to say, I walked through ALL my crypto analysis in my general chat for free and I would encourage all of you to make a free account, join, and read along to get a better understanding of how I could know it would crash, and how I would know that Bitcoin, which usually is quite silent on weekends, could crash even during this weekend at the time of current writing.

04-03-2025 I am beginning to see an increased risk of a Bitcoin collapse towards 50k taking place here, making an almost one-to-one, candle by candle print with the Tech stocks. If Nasdaq decides to just collapse here with little to no retracement, favoring my longer term nasdaq shrots, I think Crypto is in for some real pain. I removed the support level in anticipation of a break.

Long Term Levels: An emphasis on Macro economics, Monthly, Weekly and Daily timeframes. “MWD Bias Shift Levels”

Short Term Levels: An emphasis on economic releases, with Intraday charts on H1, 15m, 5m, 1m.

Intraday Levels: Become a PAID Subscriber.

Many of the views & opinions shared in this free blog is based on my much more advanced and in-depth analysis from my Founder content. I do NOT check for typos! This post may be edited to ADD content but NEVER DELETE trade-specific content

Thank you for taking your time reading and watching my content. I would appreciate if you would like/retweet/restack/comment to motivate and improve my production quality.

If I have time, I will comment on Crypto, Oil & Metals before tomorrow Monday, otherwise stay tuned in my General Chat and I will share as I see something. Crypto has been overwhelmingly boring and I may not be interested in it until something triggers.

My general market watchlist includes:

EURUSD, GBPUSD, Gold, Silver, Oil, SNP 500 , Nasdaq, Dow Jones, NQ/ES/YM, Bonds, Dollar, Commodity Futures and Crypto.

I share my general plans by way of arrows, which are based on the analysis I share in the Founder analysis videos. All my subscribers have access to these plans, but there is no guarantee I will be around to trade these plans in all my markets, so even if I miss a trade, it can be of use to you. For more precision, follow my live executions with a paid subscription. 7 day free trial is open.

If you want to see me execute trade ideas based around these trade prediction arrows, I highly recommend you become a paid subscriber. 7 day free trial available. If you want me to show you the analysis that justifies how I can predict the markets like this, I recommend you become a Founder.

Theo

Disclaimer: All views and opinions expressed in this blog are solely my own and are presented for educational purposes only, without the use of real money. All strategies, methods and concepts used by me, may one day, and suddenly, stop working. My weekly & daily studies may touch on subjects such as Futures, Stocks, Politics, Bonds, Forex, and Cryptocurrencies. I strongly advise against taking any action based on this content. Engaging in trading involves significant risk, and trading on margin can result in total loss of capital. You are solely responsible for your decisions, actions, trading, and investment choices. The blog’s contributors, including owners, writers, authors, moderators, and any mentioned entities or individuals, are not affiliated with any securities broker-dealers, investment advisors, or any regulatory authorities in the U.S., including the CFTC or the Securities and Exchange Commission. By reading this newsletter/blog, you explicitly agree to these terms. Any images or charts posted here are credited to TradingView & ForexFactory. All content on this blog is the intellectual property of the author. Do NOT share or copy any of the content on the blog without authorization from the author.

THE GOOOOAT