Daily Market Support & Resistance Levels: Arrow Predictions

05-12-2025 - Tariff Pause & FX + Indices focus.

Trading Performance Report

ATTENTION! - If you are new, YOU MUST start here (link below):

Introduction & Guide: "Tracked & Timestamped"

You will NOT understand the context of my analysis and support & resistance levels, without.

Congratulations to “Matt” who won the raffle this week (link) and has won a paid/Founder subscription value of 7 days.

➡️Watch All My Previous Daily Market Support & Resistance Arrow Predictions Here

All-Time Trading Performance Report

➡️ See Full Data Here: (Click Link)

https://www.theobeownsya.substack.com

Risk Per Trade: 0.25%

- All Time Trading Statistics -

💰 Starting Balance: 🟢 $100,000

💸 Balance Today: 🟢 $11,832,008

💰 Total Gain %: 🟢 11732.01%

🔢 Total Net RR: 🟢 2496

📈 RR Per Month: 🟢 91

🏆 Winrate: 🔴 42%

📈 Profit % Per Day: 🟢 14%

📈 Profit % Per Year: 🟢 5197%

🔢 RR Per Trade: 🟢 0.20

🔢 Profit Factor: 🟢 1.38

🔢 Max Drawdown %: 🟢 14.57%

📅 Trading Start Date: 01-08-2023

↔️ Trading End Date: 04-11-2025

🗃️📋 Preliminary Notes 📋🗃️

With US / China “pause” coming about now revealing why FOMC week was so lackluster, we now have a technical situation where Tariff levels have been broken, at least with respects to equities. Simultaneously, this “pause” should set the sentiment aspect that’s hinged on Tariffs on pause as well, meaning whatever correlations and volatility injections related to it “unless” the pause breaks, will lead to caution on my behalf in terms of some of the breaks in correlations we have seen. For instance, will the USD return to a more inverse relationship with equities now?

With such an extreme Monday reaction, CPI on Tuesday is next in line and I wonder if it will be extreme volatility as well. I think everything is on the table in terms of volatility, but we may see more muted “pro-direction” of this tariff news that came out.

Commodities. You guys know I have been hyper bullish on Coffee recently, and I am riding a trade there (half profits taken). These are soft-assets though, and I think we are going to see a rotation out of Gold and softs into these HARD industrial commodities that seem to be ever-so headlined, most recently with the US/Ukraine mineral deal. Yes, I believe we are going to see explosion in things like Uranium, aluminum & other metals. For most of these trades, I will continue to rely on my CFTC/Technical strategy, which so far has carried us greatly, but it may be time to apply that to some of these harder commodity assets as well, if the technical deterioration combined with anti-US multilayered sentiment collapse is going to continue the next 3-4 years.

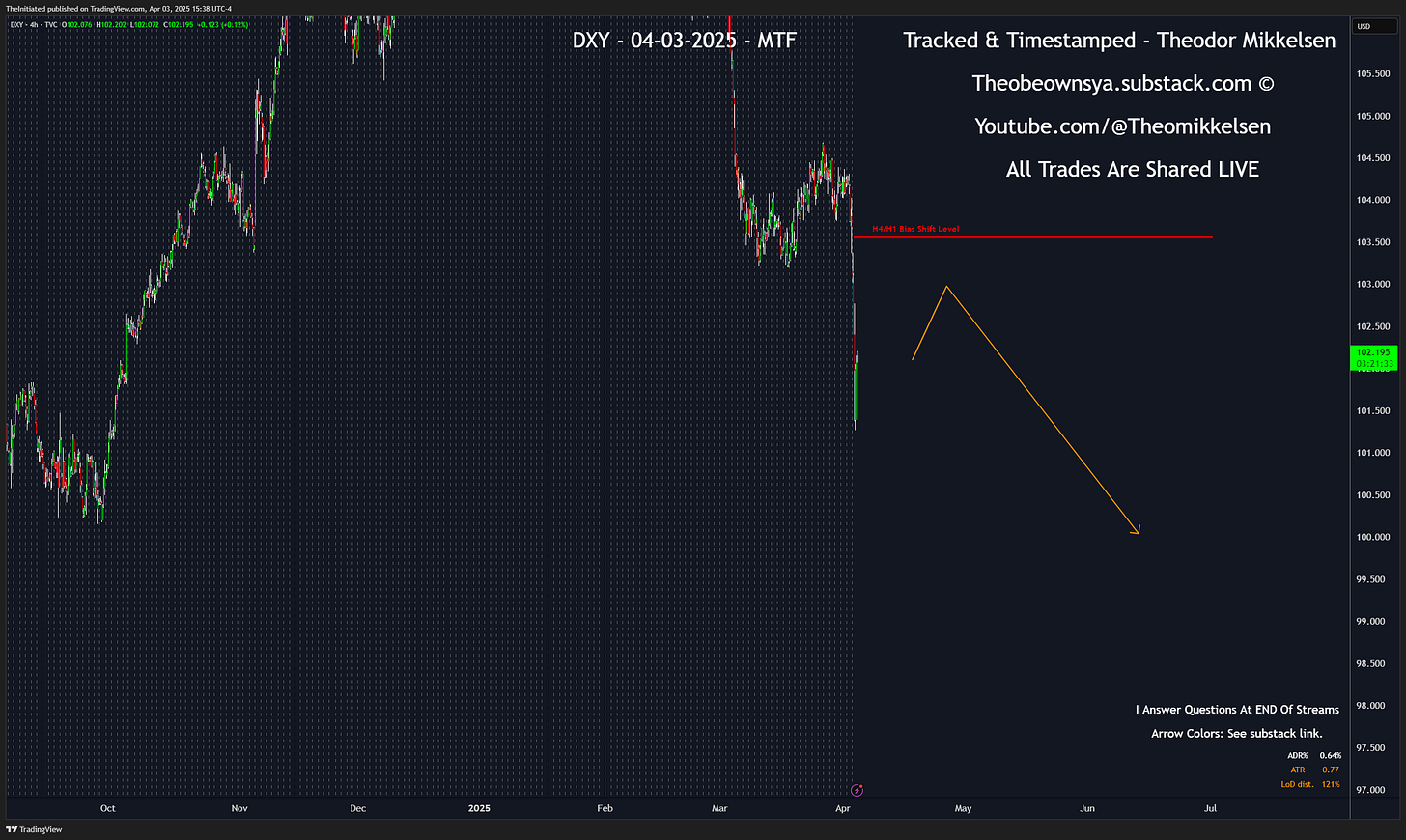

💵 💶💷 Forex (DXY) 💵💶💷

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

SHORT TERM VIEW:

Key Dollar Index Support & Resistance levels: (TVC)

DXY - Long Term Bullish Above🟩100.244

DXY - Long Term Bearish Below🟥102.682

DXY - Short Term Bullish Above🟢100.244

DXY - Short Term Bearish Below🔴102.682

Please refer to these for EURUSD as well as forex.com data

Please read the notes on Forex in my previous Arrow blog.

Pick your favorite Forex pair and trade “opposite” of what the DXY is showing, ideally EURUSD.

05-03-2025 After we saw expected increased volatility in the Forex market FAIL to kick in, with almost two weeks of flat consolidation, I am firmly standing by this assessment continuing into next week. Not to underplay volatility in say, equities market, with the upcoming FED, I am expecting headlines to be made even on the oncoming committee. I am therefore strongly believing a dovish Fed expectation I have could allow USD, already immediately, to start trading higher, to then potentially come lower near or after the FOMC.

I had changed my sentiment of FED stance to “hawkish” as I gained new information going into the week of FOMC, and I held a firm bias that the volatility in Forex was going to come in, and I was expecting the DXY to come firmly up, as a part of a move to potentially continue lower. We, very happily, have now seen that take places, as can be seen in the chronological display of screenshots I have provided for free, including S/R levels.

📉📈Stocks & Indices📈📉

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

SHORT TERM VIEW:

Key Stocks & Indices Support & Resistance levels:

ES - Long Term Bullish Above🟩5202.25

ES - Long Term Bearish Below🟥5993.75

ES - Short Term Bullish Above🟢5680.50

ES - Short Term Bearish Below🔴5993.75

Please refer to the current front contract on barchart.com or Tradingview.com

Favoring an upmove to come down, but we getting into a bit of shaky territory in terms of expected higher-than-normal volatility which has been with us since Tariffs. I do however generally suspect, ATH is next here, at least on one of the major indices.

⚡⛽Energies⛽⚡

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

SHORT TERM VIEW:

CL - Long Term Bullish Above🟩 N/A

CL - Long Term Bearish Below🟥63.21

CL - Short Term Bullish Above🟢N/A

CL - Short Term Bearish Below🔴58.95

Please refer to the current front contract on barchart.com or Tradingview.com

Will edit post and update oil levels today.

🥈🥇Metals:🥇🥈

Chronological Screenshots Shared In Last 4-8 Blogs:

Key Gold GC Support & Resistance levels:

GC - Long Term Bullish Above🟩2872.4

GC - Long Term Bearish Below🟥N/A

GC - Short Term Bullish Above🟢3240.4

GC - Short Term Bearish Below🔴N/A

Please refer to the current front contract on barchart.com or Tradingview.com

Will edit post and update gold levels.

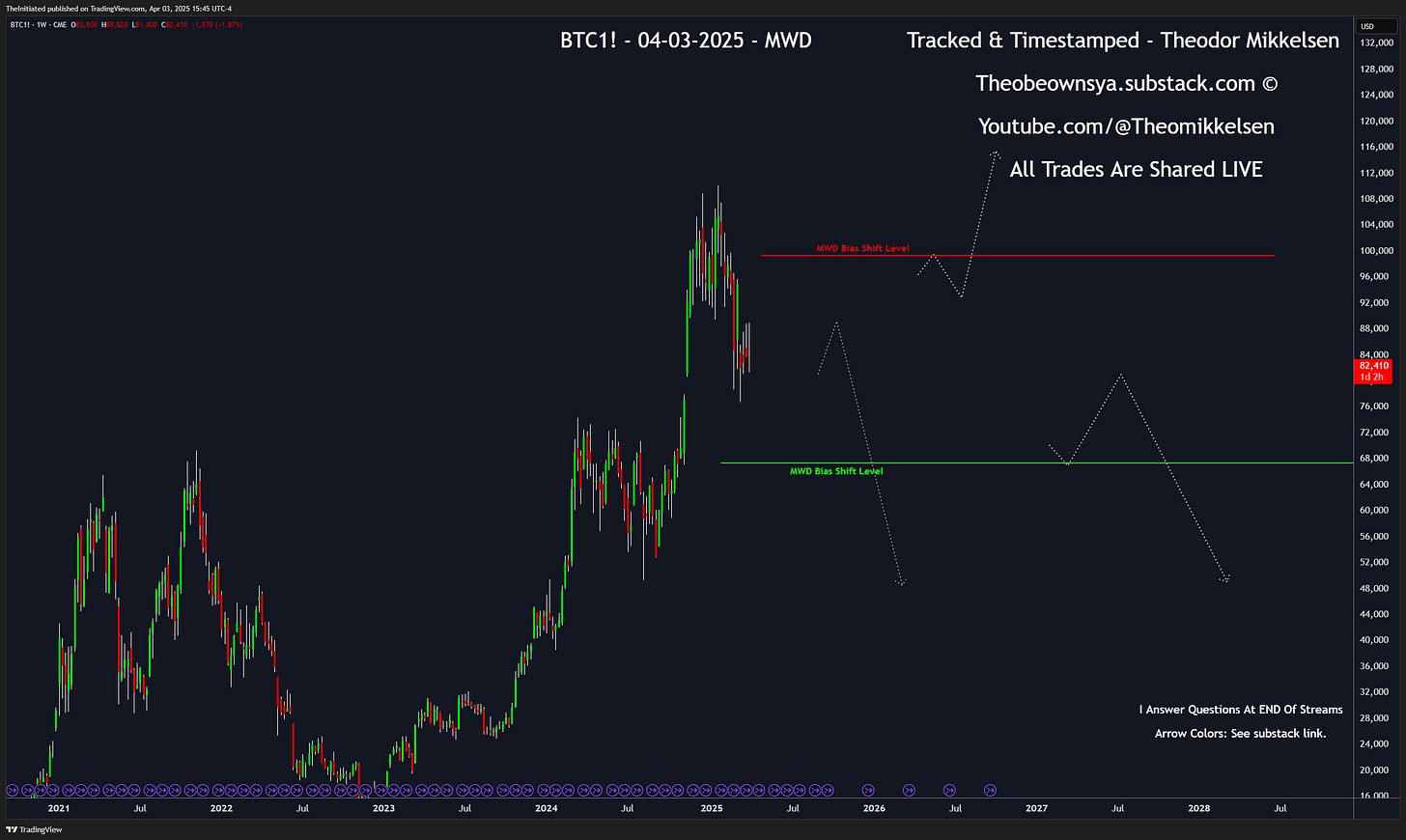

🗑️💩 Crypto 💩🗑️

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

Key Bitcoin Support & Resistance levels:

BTC - Long Term Bullish Above🟩84450.37

BTC - Long Term Bearish Below🟥N/A

BTC - Short Term Bullish Above🟢84450.37

BTC- Short Term Bearish Below🔴N/A

Please refer to the current front contract on barchart.com or Tradingview.com & Binance

Will edit and update levels on Bitcoin later.

Long Term Levels: An emphasis on Macro economics, Monthly, Weekly and Daily timeframes. “MWD Bias Shift Levels”

Short Term Levels: An emphasis on economic releases, with Intraday charts on H1, 15m, 5m, 1m.

Intraday Levels: Become a PAID Subscriber.

Many of the views & opinions shared in this free blog is based on my much more advanced and in-depth analysis from my Founder content. I do NOT check for typos! This post may be edited to ADD content but NEVER DELETE trade-specific content

Thank you for taking your time reading and watching my content. I would appreciate if you would like/retweet/restack/comment to motivate and improve my production quality.

If I have time, I will comment on Crypto, Oil & Metals before tomorrow Monday, otherwise stay tuned in my General Chat and I will share as I see something. Crypto has been overwhelmingly boring and I may not be interested in it until something triggers.

My general market watchlist includes:

EURUSD, GBPUSD, Gold, Silver, Oil, SNP 500 , Nasdaq, Dow Jones, NQ/ES/YM, Bonds, Dollar, Commodity Futures and Crypto.

I share my general plans by way of arrows, which are based on the analysis I share in the Founder analysis videos. All my subscribers have access to these plans, but there is no guarantee I will be around to trade these plans in all my markets, so even if I miss a trade, it can be of use to you. For more precision, follow my live executions with a paid subscription. 7 day free trial is open.

If you want to see me execute trade ideas based around these trade prediction arrows, I highly recommend you become a paid subscriber. 7 day free trial available. If you want me to show you the analysis that justifies how I can predict the markets like this, I recommend you become a Founder.

Theo

Disclaimer: All views and opinions expressed in this blog are solely my own and are presented for educational purposes only, without the use of real money. All strategies, methods and concepts used by me, may one day, and suddenly, stop working. My weekly & daily studies may touch on subjects such as Futures, Stocks, Politics, Bonds, Forex, and Cryptocurrencies. I strongly advise against taking any action based on this content. Engaging in trading involves significant risk, and trading on margin can result in total loss of capital. You are solely responsible for your decisions, actions, trading, and investment choices. The blog’s contributors, including owners, writers, authors, moderators, and any mentioned entities or individuals, are not affiliated with any securities broker-dealers, investment advisors, or any regulatory authorities in the U.S., including the CFTC or the Securities and Exchange Commission. By reading this newsletter/blog, you explicitly agree to these terms. Any images or charts posted here are credited to TradingView & ForexFactory. All content on this blog is the intellectual property of the author. Do NOT share or copy any of the content on the blog without authorization from the author.

Nice :)

Raffle toimeee haha