Daily Market Support & Resistance Levels: Arrow Predictions

04-28-2025 - Preparing For Dovish FED

Trading Performance Report

ATTENTION! - If you are new, YOU MUST start here (link below):

Introduction & Guide: "Tracked & Timestamped"

You will NOT understand the context of my analysis and support & resistance levels, without.

Congratulations to “Matt” who won the raffle this week (link) and has won a paid/Founder subscription value of 7 days.

➡️Watch All My Previous Daily Market Support & Resistance Arrow Predictions Here

All-Time Trading Performance Report

➡️ See Full Data Here: (Click Link)

https://www.theobeownsya.substack.com

Risk Per Trade: 0.25%

- All Time Trading Statistics -

💰 Starting Balance: 🟢 $100,000

💸 Balance Today: 🟢 $11,832,008

💰 Total Gain %: 🟢 11732.01%

🔢 Total Net RR: 🟢 2496

📈 RR Per Month: 🟢 91

🏆 Winrate: 🔴 42%

📈 Profit % Per Day: 🟢 14%

📈 Profit % Per Year: 🟢 5197%

🔢 RR Per Trade: 🟢 0.20

🔢 Profit Factor: 🟢 1.38

🔢 Max Drawdown %: 🟢 14.57%

📅 Trading Start Date: 01-08-2023

↔️ Trading End Date: 04-11-2025

🗃️📋 Preliminary Notes 📋🗃️

Preparing for FED headline takeover Wednesday, as tariff & inflation volatility risks may be behind us. A bit of action potentially on Monday as well, take it as it goes.

Also quickly: Thank you guys for following me in my notes tab, it seems to be garnering a bit more attention and I will make sure to be using that as a journal going forward. Provided, of course, it stays as so and is allowed so!

Clearly this week, the main news focus will be the FOMC. I suspect depending on where the DXY is at, I will be leaning on either dovish or hawkish remarks. They will not be changing the rates this time, very unlikely. There needs to be a slow releasestream to manipulate the masses and markets steadily, controllably. A rate adjustment this quickly, in conjunction with what has been said the last few meetings, notably NOT reacting to US politics and sticking to numbers, would be relentless. Next question is, what is the longer term gameplan, how does FED navigate and instigate FED policy without blame of reaction to Trump u-turnism?

Well, I am not centered on the macroeconomics surrounding the aftermath of the tariff stunt that took place, but the US bond market is historically low in broad valuations, and there has been headlines about the pressure put on it simultaneously with the high debt, and correlations with other major assets. So, if it were to come up, rates are likely to come down. But what if they don’t? What if this US bond market is just going to be… well… less demanded, trillions to seek elsewhere?

I am viewing this WHOLE theater with two things in mind.

Post-Trump elections and the general sentiment abroad is “boycott the US”, but to what degree this is happening at the peasant level, commercial level, or the larger institutional level, at the same time, is more unclear to me. I do not trust the information coming out regarding that except at the peasentry level. And to some end, commercial and institutional business must level with the peasent level. And if this stands true, the FED will be in a position where US capital in the global US dominated trade system is NOT returning back to the US. Foreign investment would be seeking foreign VR, etc. Perhaps most importantly, we are seeing BRICS trying to set up their entire ecosystem.

With this in mind, we can speculate what the FOMC rate direction could be under Trump, and if my original thesis is correct, shit will go down with Trump at the east, and Harris-like presidency will take over next. And for that to happen, interest rates are going to come up. Then we will see if this flushout will create light at the end of the tunnel for who takes over the office next. As for now, I am viewing these two outcomes the next 5-10 years:

NUMBER ONE: Are we going to see the US dominancy, The USD, “FALL” under Trump, by design?

I have been having this thought since way before elections, as well as when I tweeted it would be better for world had Harris won. We may see the reasons for that, soon. This has been sentiment circling around and headlining for a while, but when something doesn’t take place for 5 years, and suddenly takes places, it’s no longer news, it’s just a slowly implemented reality. So, this may in fact be the route the FED takes us, and with that, Higher Rates To Come. I think this outcome is a potential, even without WW3.

NUMBER TWO: The changing world order fails to come about, and WW3 starts. Sparing the panic, what I mean here is that the only thing that could upset ANY predictions, and be a wildcard for the US, is to make “use” of the “51st Canada State” and “Greenland” and whatnot. Secure territory essential for domestic produce (that can help avoid outcome number one) while also forcing Europe into self-sufficiency on defense (already taking place) and destroying relationships with them in the process, and then ANYTHING Ukraine, Taiwan, Panama, Arctic military presence etc. in the midst. Right now, I think first outcome is happening regardless of a war, regardless of whether we establish peace in Ukraine etc. Number two will depend on Trump administration radicalism.

Trump knows it will be bullish for stocks if rates go down, and I wonder if “someone else” is interested in that NOT happening and the entire storyline of “Trump failure” will take place. What happened to crypto strategic reserves, by the way? Right. Sidenotedly, I wonder how this has impacted Trumps relationship with Zelenskyj and the stance on Russia that is to take place there. Had there been a more noticeably US-favorable outcome, specifically on downside global market turmoil, perhaps US would have been more on Russia/Chinese side and a resolution to the war could’ve taken place.

So in short: I am maintaining a bullish bias in crypto, bearish bias on the USD, and bullish bias on the stock market. I am only playing headline-to-headline on the interest rates as we can match it technically. Overall, it is hard for me to not connect the dots around the potential of a falling US dollar. Sentiment matches, fundamentally Trump would cause so, and while he is desperate to keep stocks afloat but hoping for lower interest rates, the inverse relationship between USD and US stock market is tremendously remarkable. For Gold to go up further, I think its going to need surprise negative event-driving surrounding the war, perhaps adjacent to the aftershocks of the Tariffs. But certainly I remain a longer term bear on the USD. The US stock market may not be headed for massive ATH breaks, but I remain bullish there as well, probably riding the wave of the leftover juice spawned by the Tariff U-Turn. Bitcoin? I am mostly technically bullish here. I don’t like the open liquidity that is left intact here to put it in a similar position with something like Gold or as a safe-haven assets amidst this turmoil, but it does look like it could touch ATH.

Commodities. You guys know I have been hyper bullish on Coffee recently, and I am riding a trade there (half profits taken). These are soft-assets though, and I think we are going to see a rotation out of Gold and softs into these HARD industrial commodities that seem to be ever-so headlined, most recently with the US/Ukraine mineral deal. Yes, I believe we are going to see explosion in things like Uranium, aluminum & other metals. For most of these trades, I will continue to rely on my CFTC/Technical strategy, which so far has carried us greatly, but it may be time to apply that to some of these harder commodity assets as well, if the technical deterioration combined with anti-US multilayered sentiment collapse is going to continue the next 3-4 years.

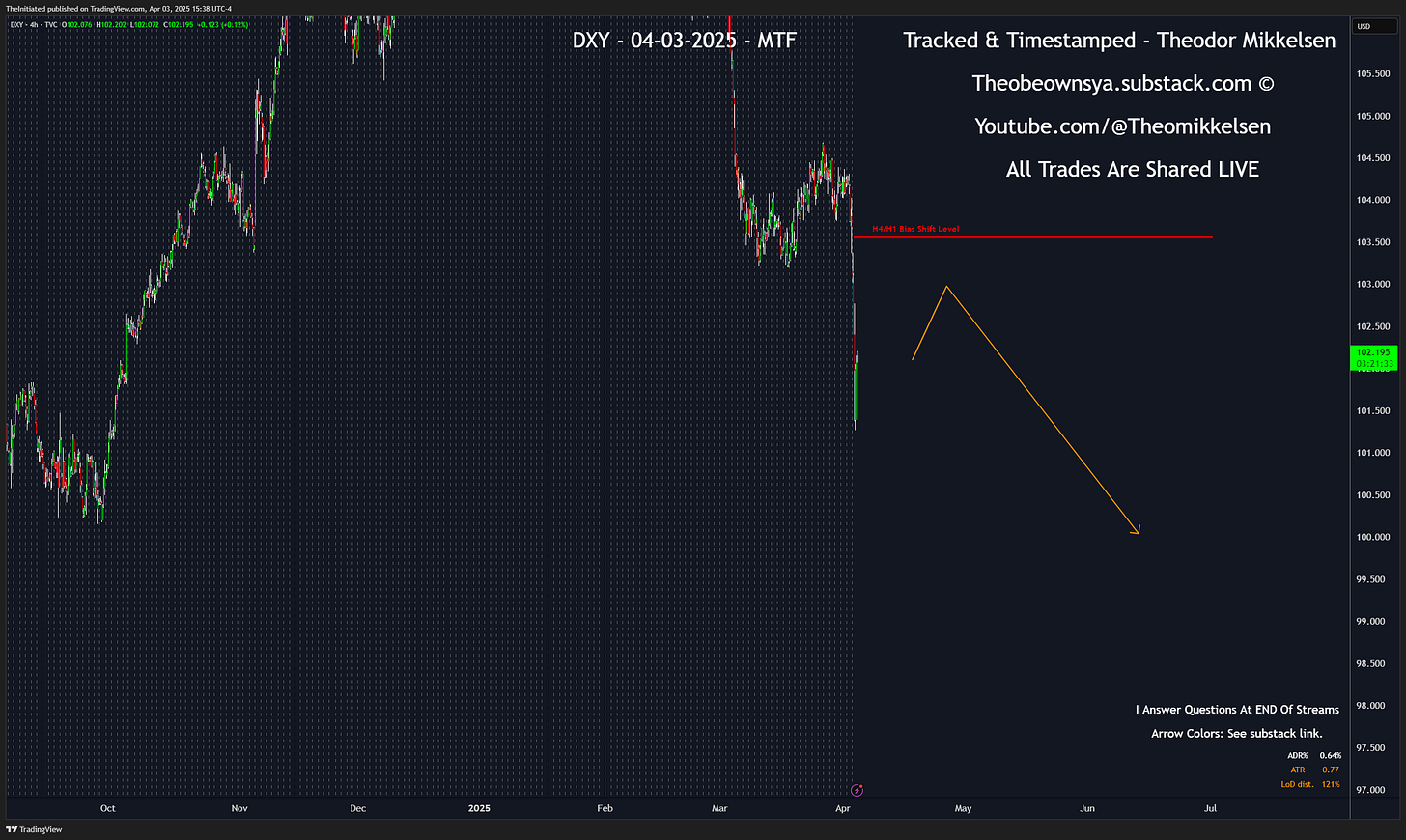

💵 💶💷 Forex (DXY) 💵💶💷

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

SHORT TERM VIEW:

Key Dollar Index Support & Resistance levels: (TVC)

DXY - Long Term Bullish Above🟩N/A

DXY - Long Term Bearish Below🟥107.661

DXY - Short Term Bullish Above🟢99.159

DXY - Short Term Bearish Below🔴102.405

Please refer to these for EURUSD as well as forex.com data

Please read the notes on Forex in my previous Arrow blog.

04-27-2025 - The USD is possibly going to be more volatile than the stock market, unless we start giving up my levels as I will appoint below. This will also be hugely factored by my predicting of FED cutting coming up in may, and I think the deterioration of the currency also will be associated with the negative Sentiment from key US allies being put upon the administration, as the dislike for the bombastic in-and-out executive orders have shocked the world. Whether I am right it goes down, is left to see.

05-03-2025 After we saw expected increased volatility in the Forex market FAIL to kick in, with almost two weeks of flat consolidation, I am firmly standing by this assessment continuing into next week. Not to underplay volatility in say, equities market, with the upcoming FED, I am expecting headlines to be made even on the oncoming committee. I am therefore strongly believing a dovish Fed expectation I have could allow USD, already immediately, to start trading higher, to then potentially come lower near or after the FOMC.

📉📈Stocks & Indices📈📉

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

SHORT TERM VIEW:

Key Stocks & Indices Support & Resistance levels:

ES - Long Term Bullish Above🟩5259.75

ES - Long Term Bearish Below🟥5692.75

ES - Short Term Bullish Above🟢5469.25

ES - Short Term Bearish Below🔴5692.75

Please refer to the current front contract on barchart.com or Tradingview.com

Favoring an upmove to come down, but we getting into a bit of shaky territory in terms of expected higher-than-normal volatility which has been with us since Tariffs. I do however generally suspect, ATH is next here, at least on one of the major indices.

⚡⛽Energies⛽⚡

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

SHORT TERM VIEW:

CL - Long Term Bullish Above🟩 N/A

CL - Long Term Bearish Below🟥63.21

CL - Short Term Bullish Above🟢N/A

CL - Short Term Bearish Below🔴58.95

Please refer to the current front contract on barchart.com or Tradingview.com

I did not have a correct alignment fundamentally with my expectation of oil going higher, and adapted my technical studies to that fact. Right now, I don’t see a bullish scenario that I am looking for, so just very casually studying it going lower, until something bullish presents itself.

🥈🥇Metals:🥇🥈

Chronological Screenshots Shared In Last 4-8 Blogs:

Key Gold GC Support & Resistance levels:

GC - Long Term Bullish Above🟩2872.4

GC - Long Term Bearish Below🟥N/A

GC - Short Term Bullish Above🟢3240.4

GC - Short Term Bearish Below🔴N/A

Please refer to the current front contract on barchart.com or Tradingview.com

04-20-2025 - I will be posting an analysis on gold if I manage to get to do it on time, editing this post. For now, I think it looks bullish at a first glance.

04-28-2025 Status Quo.

I think we may be coming higher on gold here very short term, but hard to have much more than a slight outlook.

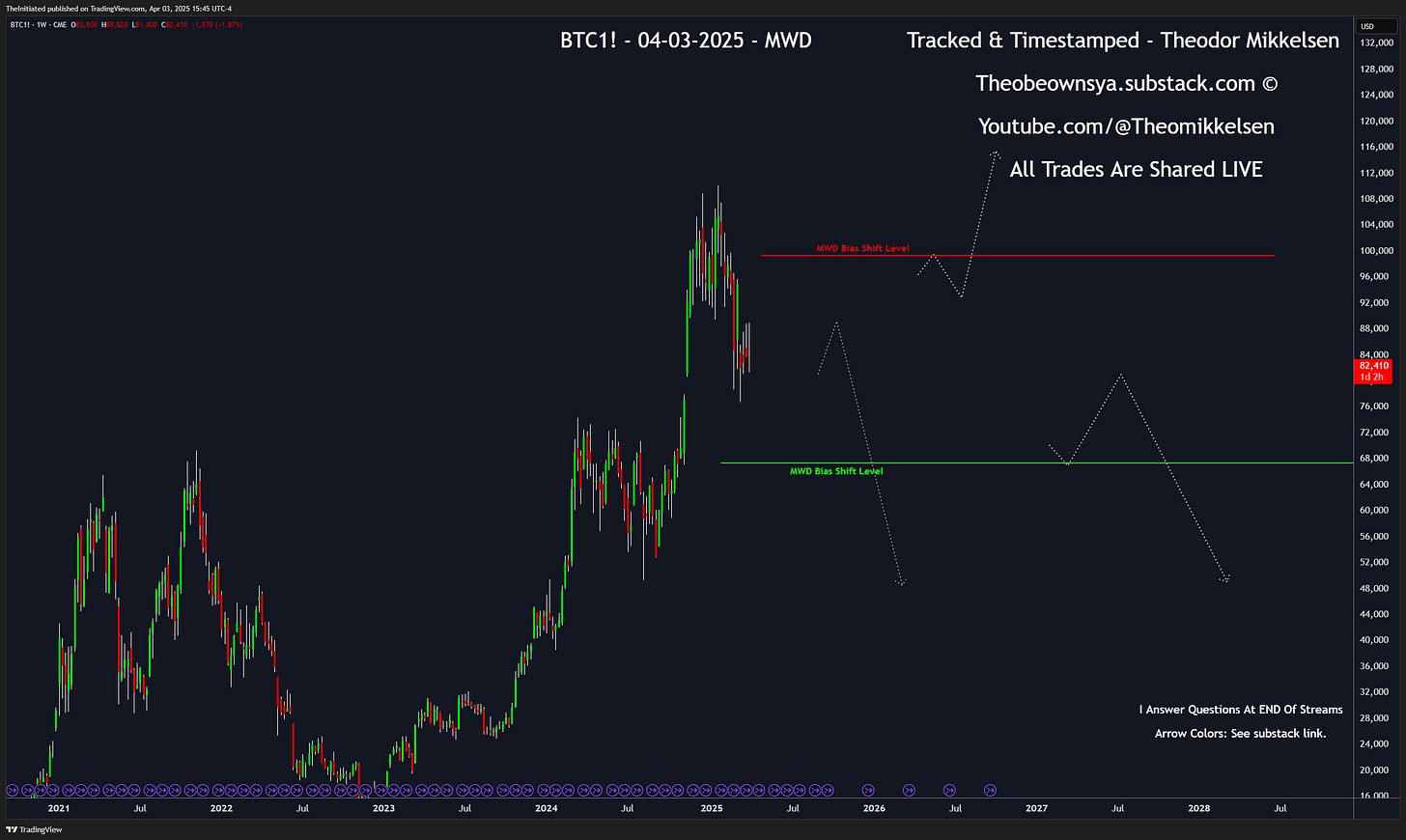

🗑️💩 Crypto 💩🗑️

Chronological Screenshots Shared In Last 4-8 Blogs:

LONG TERM VIEW:

Key Bitcoin Support & Resistance levels:

BTC - Long Term Bullish Above🟩84450.37

BTC - Long Term Bearish Below🟥N/A

BTC - Short Term Bullish Above🟢84450.37

BTC- Short Term Bearish Below🔴N/A

Please refer to the current front contract on barchart.com or Tradingview.com & Binance

04-28-2025 - I subtly believe bitcoin should continue higher, as long as we maintain the combined Long Term and Short term level. We have been trading it very succesfully.

05-05-2025 15:43:00 I maintain a bullish bias on crypto, while I am holding four positions short on BTCUSD, shared live earlier:

Long Term Levels: An emphasis on Macro economics, Monthly, Weekly and Daily timeframes. “MWD Bias Shift Levels”

Short Term Levels: An emphasis on economic releases, with Intraday charts on H1, 15m, 5m, 1m.

Intraday Levels: Become a PAID Subscriber.

Many of the views & opinions shared in this free blog is based on my much more advanced and in-depth analysis from my Founder content. I do NOT check for typos! This post may be edited to ADD content but NEVER DELETE trade-specific content

Thank you for taking your time reading and watching my content. I would appreciate if you would like/retweet/restack/comment to motivate and improve my production quality.

If I have time, I will comment on Crypto, Oil & Metals before tomorrow Monday, otherwise stay tuned in my General Chat and I will share as I see something. Crypto has been overwhelmingly boring and I may not be interested in it until something triggers.

My general market watchlist includes:

EURUSD, GBPUSD, Gold, Silver, Oil, SNP 500 , Nasdaq, Dow Jones, NQ/ES/YM, Bonds, Dollar, Commodity Futures and Crypto.

I share my general plans by way of arrows, which are based on the analysis I share in the Founder analysis videos. All my subscribers have access to these plans, but there is no guarantee I will be around to trade these plans in all my markets, so even if I miss a trade, it can be of use to you. For more precision, follow my live executions with a paid subscription. 7 day free trial is open.

If you want to see me execute trade ideas based around these trade prediction arrows, I highly recommend you become a paid subscriber. 7 day free trial available. If you want me to show you the analysis that justifies how I can predict the markets like this, I recommend you become a Founder.

Theo

Disclaimer: All views and opinions expressed in this blog are solely my own and are presented for educational purposes only, without the use of real money. All strategies, methods and concepts used by me, may one day, and suddenly, stop working. My weekly & daily studies may touch on subjects such as Futures, Stocks, Politics, Bonds, Forex, and Cryptocurrencies. I strongly advise against taking any action based on this content. Engaging in trading involves significant risk, and trading on margin can result in total loss of capital. You are solely responsible for your decisions, actions, trading, and investment choices. The blog’s contributors, including owners, writers, authors, moderators, and any mentioned entities or individuals, are not affiliated with any securities broker-dealers, investment advisors, or any regulatory authorities in the U.S., including the CFTC or the Securities and Exchange Commission. By reading this newsletter/blog, you explicitly agree to these terms. Any images or charts posted here are credited to TradingView & ForexFactory. All content on this blog is the intellectual property of the author. Do NOT share or copy any of the content on the blog without authorization from the author.